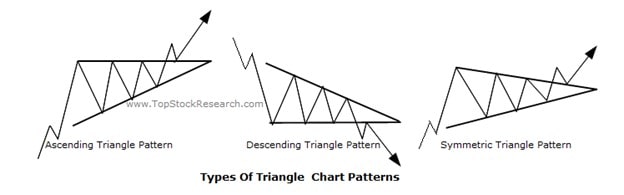

Investors tend to use different tools to define market direction - technical indicators, candlestick, and chart patterns are all key to successful trading. There is a wide range of chart patterns, and one of them is triangles. Overall, we can pinpoint three types of triangles: ascending, descending, and symmetrical. The ascending triangle is one of the simplest and well-known patterns. So, today we will talk about the ascending triangle and teach you how to recognize and trade it.

Triangles in Trading: What Is It?

Before we talk in-depth about the ascending triangle, we should take a closer look at triangle patterns in general. Triangle is a continuation pattern. It signals the market will coincide in the direction it had before the pattern was formed (except the symmetrical one). Also, any triangle is a period of a corrective price. The market consolidates and, only after, moves in the direction of the main trend.

The pattern is shaped by two trendlines - support and resistance levels. The pattern is considered to be formed if support and resistance levels connect at least five highs and lows. It can be either three highs and two lows or two highs and three lows.

Triangle is a continuation pattern that is shaped by two trendlines. The pattern is considered formed if support and resistance levels connect at least five highs and lows. There are three types of triangles - ascending, descending, and symmetrical. The idea of any triangle pattern is that the price should break either support or resistance, showing the market direction.

Why is it a triangle? Because the price moves in the shape of a triangle. Look at the picture below to see for yourself.

Triangles: Short Description

Here are short descriptions of triangle types

A descending triangle is opposite to the ascending triangle. The market forms lower highs - thus, the resistance line moves down. At the same time, the support line is horizontal. If the market falls below the bottom line, the downtrend will continue. Later on, we will tell more about the differences between ascending and descending triangles.

A symmetrical triangle doesn't match the idea of the previous direction continuation. Within the symmetrical triangle, the price forms higher lows and lower highs. Thus, support and resistance levels meet at one point. There is no clarity on the further market direction, and traders simply wait for the breakout. Thus, if the price breaks above the resistance level, the market will move upside. If the support line is broken, the market will drop.

You will learn about the ascending triangle in the sections below.

What Is an Ascending Triangle Pattern, and How Does It Work?

An ascending triangle is a continuation chart pattern that relates to a group of triangle patterns. It's a bullish pattern that signals an upward movement. As you can see, there is horizontal resistance, but the lows go up so the price creates higher lows.

An ascending triangle is a bullish continuation chart pattern that signals an upward movement. The signal of the pattern works if the price breaks above the resistance level.

Why is it a bullish pattern? There is a resistance level, and it seems the market won't go upwards. Still, as there are higher lows, bulls have the strength to push the price above the resistance. However, it's not always the case. There are situations when bulls don't have the power to push the price and the market moves sideways or goes downside.

It can happen due to unexpected market events. Imagine the market has formed an ascending triangle of the EUR/USD pair, but the ECB provides comments on the loose monetary policy. The Euro won't have the power to move up.

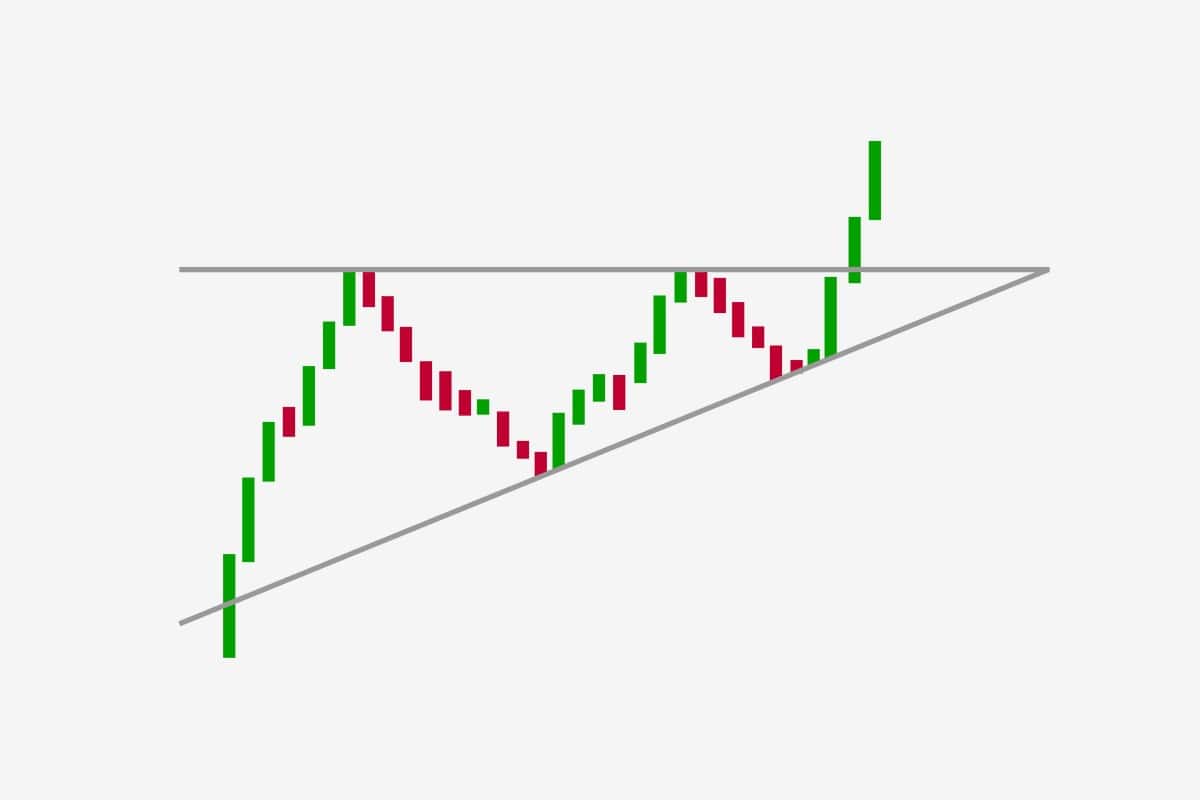

Ascending Triangle: Real Example on the Forex Market

Each chart created for educational purposes has an ideal form of the pattern. However, it's unlikely that you will find the same shape on the real market. That's why we are showing a real example that will show you how the ascending triangle looks like.

On the hourly chart of the US dollar index, you can see the ascending triangle.

Advantages and Disadvantages of an Ascending Triangle

Any pattern or technical indicator has pros and cons. The ascending triangle is no exception.

|

Advantages |

Disadvantages |

|

|

The ascending triangle is one of the easiest patterns. All you need to do is to draw two lines connecting highs and lows. Also, you don't need to remember lots of information about the pattern. It provides easy signals and works similarly for any asset, from Forex to stocks. Another advantage is that you can find the pattern at any timeframe.

However, there are limitations of this pattern. The first one is fake signals - the price can break above the resistance, but the market won't keep rising, moving below the resistance level. As we have mentioned, bulls can lack the force to push the price above the resistance. Although you can find the ascending triangle at any timeframe and for any asset, it's a rare pattern.

Also, you will never find a perfect triangle on the price chart. For instance, it is sometimes unclear whether it's a triangle or a wedge.

How to Determine an Ascending Triangle

The ascending triangle is a simple pattern. Still, you should keep in mind some points that can identify it. Below you can find the conditions:

- Upward movement. The ascending triangle is a continuation pattern and signals an upward movement. Thus the market should be in the uptrend before the formation of the triangle.

- Market consolidation. As you could see in the images above, the market consolidates within two borders. It's an important condition.

- Higher lows. The price should form higher lows - meaning, traders understand bulls have the force to push the price up.

- Flat resistance. The upper line of the triangle should be horizontal. This line is resistance that serves as a barrier for upward movement. A price reversal from this level is expected.

- Breakout. The final phase of the ascending triangle is a breakout of the upper boundary of the pattern.

Ascending and Descending Triangles in Trading: Where the Difference Lies

Ascending and descending triangles are the opposite types of the triangle pattern. Below you can find the exact differences.

|

Characteristics |

Ascending triangle |

Descending triangle |

|

Signal |

Upcoming uptrend |

Upcoming downtrend |

|

Resistance |

Horizontal |

Lower highs |

|

Support |

Higher lows |

Horizontal |

The main difference between ascending and descending triangles is the market direction. The ascending pattern predicts the price to ascend in the foreseen future. Buyers wait for a breakout and open a position. As for the descending triangle, sellers anticipate the price to descend, continuing the downtrend.

The main difference between ascending and descending triangles is the market direction. The ascending pattern predicts the price to ascend and vice versa.

Patterns look different. The ascending triangle has a flat upper boundary, while the descending triangle has lower highs. As for the bottom line, the ascending triangle has a slope of higher lows, and at the same time, the bottom line of the descending pattern lies horizontally.

How to Use an Ascending Triangle in Trading - the Best Strategies

We have a couple of the most effective strategies for you to trade the ascending triangle successfully.

Strategy #1: Wrong Ascending Triangle

We already mentioned that the ascending triangle signals an upward movement. Still, it's not a strict rule - the market can move in the opposite direction if bulls are not strong enough. This strategy will tell you how to deal with the wrong ascending triangle.

- Step 1. It’s always better to wait for confirmation. Never open a trade before the breakout occurs. Imagine the price broke the support level of the ascending triangle - this is a signal to open a sell position.

- Step 2. Place Take Profit level. The distance can be measured very easily. All you need is to count the number of pips from the beginning of the triangle to its high. The same number of pips can be set from the high of the triangle down.

- Step 3. The Stop Loss level can be placed several pips above the support line. Usually, it's 3-10 pips depending on the timeframe.

Strategy #2: Real Triangle

This is the most common strategy of the ascending triangle.

- Step 1. Wait for the ascending triangle to be formed. If you remember the first part of our tutorial, we mentioned there should be at least five highs and lows.

- Step 2. Wait for a breakout. The price should close above the resistance level. Afterwards, you can open a long position.

- Step 3. The measuring of the Take Profit level is done in the following way. You should count the number of pips from the lowest point of the triangle to the horizontal resistance. This number should be placed from the breakout until the TP level.

- Step 4. Stop Loss level should be located from 3 to 10 pips below the resistance (depending on the timeframe).

Conclusion: the Ascending Triangle in Trading

Let's round up. The ascending triangle is a continuation chart pattern that signals an upward movement after the resistance level's breakout. Overall, the pattern is simple. You just need to connect highs and lows with support and resistance levels.

Still, you can’t always count on the triangle to work as you expected. That's why you should have enough experience to deal with the pattern. For that, you can use a trading demo account of Libertex broker. The account provides a wide range of instruments: from Forex to CFDs. Get a chance to upgrade your skills in a safe environment.

Why to trade with Libertex?

- access to a demo account free of charge

- technical assistance to the operator 5 days a week, from 8 a.m. till 8 p.m. (Central European Standard Time)

- leverage of up to 1:600 for professional Ñlients

- operate on a platform for any device: Libertex and Metatrader

FAQ

Let's sum up the information by answering the following questions.

How to Trade an Ascending Triangle?

To trade the ascending triangle, you should open a buy position when the price breaks above the resistance level.

What Is the Ascending Triangle in Stocks?

The ascending triangle is the same for any asset you trade. Thus, the triangle in stocks is the bullish continuation pattern that signals a high probability of the uptrend.

When to Use an Ascending Triangle?

You should use the ascending triangle any time you see it on the chart. It's not the everyday pattern, so you should wait for its formation.

What Does an Ascending Triangle Mean?

The ascending triangle means there is a high chance the market will rise after the resistance breakout.

What Is an Ascending Triangle Breakout?

An ascending triangle breakout is the key point of the pattern when the price breaks above the resistance level and confirms bulls' strength.