The United States and Canada combined represent the largest stock market in the world that attracts millions of traders on a regular basis. According to the latest data, the total market capitalization of the North American stock market amounts to $51.7 trillion, with $48.6 trillion accruing to the US stock market and $3.1 trillion to the Canadian market. Despite the ongoing global turmoil, the total market value of US companies has grown by 20.2% over the past two years, while the capitalization of corporations that have their stocks listed on major exchanges like NYSE and NASDAQ has increased by 170%. At times when the job market is drying out, and low interest rates on the back of soaring inflation make wealth generation through savings accounts and property buying far less attractive, savvy investors are turning more towards stock markets.

Broker Picking Made Easy: Top North American Stock Brokers for Inexpensive Trading

But trading on those opportunity-rich markets requires registration with one of the brokers, the number of which grows by the day. The sheer number and the variety of stock market brokers that operate in North America can be overwhelming even for an experienced investor. Some of them are good, others are outright fraudsters, but only those included in the following review can be considered the cream of the crop of the financial services industry. We have carried out a thorough analysis of all stockbrokers, their history, account variety, commissions, educational materials, and customer service and compiled an extensive list of the best US and Canadian stock brokers.

Charles Schwab

We begin our review of the top U.S. stockbrokers with Charles Schwab, the firm that belongs to the group of the four biggest financial service providers in North America, along with TD Ameritrade, E*TRADE, and Fidelity Investments, all of them reviewed in this article. The broker in question operates on a global scale and has over $7.4 trillion in total client assets, rivaled only by Fidelity Investment with its $8.3 trillion.

We begin our review of the top U.S. stockbrokers with Charles Schwab, the firm that belongs to the group of the four biggest financial service providers in North America, along with TD Ameritrade, E*TRADE, and Fidelity Investments, all of them reviewed in this article. The broker in question operates on a global scale and has over $7.4 trillion in total client assets, rivaled only by Fidelity Investment with its $8.3 trillion.

Charles Schwab has been in the business since 1971 - over these past four decades, it amassed more than 33 million active accounts and was capable of achieving the revenue of $11.7 billion (2020); once again, being outperformed only by Fidelity Investments. The company went public in 1987; its stock (SCHW) is now traded on NYSE at $80 per share, with the price being ripe to establish a new all-time high.

This financial services provider offers an array of investment products from stocks to margin lending and cryptocurrency trading. Charles Schwab also assists with financial planning, investment research and provides banking and borrowing services, making it a financial one-stop-shop of the highest caliber.

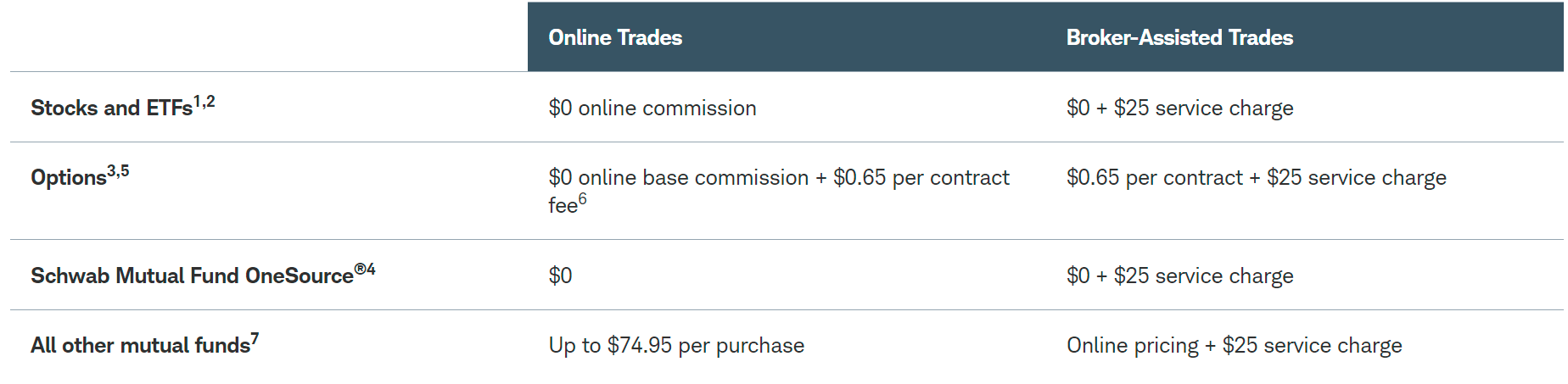

Charles Schwab Trading Fees and Commissions

When it comes to stock trading, Charles Schwab serves as a gateway to absolutely all stocks available on U.S. exchanges, as well as stocks that are traded in the over-the-counter (OTC) mode and those that are being distributed via IPOs. For those who can’t afford to invest a considerable sum in stocks, the broker offers fractional shares (Charles Stock Slices) that can be bought for as low as $5. The firm’s only downside with regard to stock trading is the lack of direct access to international markets, with the exception of Canadian markets - speculations there are done through the American Depositary Receipts (ADRs) or foreign ordinaries, which is the equivalent of the OTC market.

The broker doesn’t charge a commission for online stock trading as its business model is based on interest revenue, asset management fees, and deposit account fees. However, the no-commission rule doesn’t apply to large block transactions, trades that involve restricted stocks, or speculations directly on foreign exchanges. For stock trading, it’s best to open a Brokerage & Trading account with zero minimum deposit and no maintenance fees, although this feature is available only to U.S. customers. A foreign customer would be required to deposit no less than $25,000. Charles Schwab’s other drawbacks are that it has one base currency (USD) and charges a rather high fee when withdrawals are made via bank transfer.

Pros:

- Commission-free stock trading;

- Great research tools;

- Non-trading fees are almost negligible;

- Exceptional customer support.

Cons:

- Lacks access to international stock markets;

- Very high minimum deposit for non-US stock investors;

- Only one base currency - USD;

- Steep withdrawal fees.

Our verdict

- Overall rating - 4.5 out of 5. Obviously, Charles Schwab couldn’t have become the leading stockbroker in the United States if the firm didn’t provide top-notch financial services, including stock brokerage. However, we have reduced its score by half a point because the broker doesn’t offer direct access to international stock markets and is largely unsuitable for investors from outside the U.S.

- Commission rating - 5 out of 5. Low trading and non-trading fees are Charles Schwab’s main points of attraction, and we didn’t hesitate to award it a top score in this particular category. But stock traders shouldn’t forget about a rather long list of additional fees for things like restricted stock transactions or for making a broker-assisted trade.

- Education rating - 5 out of 5. In our experience, there is hardly any other U.S. stockbroker that offers a greater wealth of knowledge about stock trading (and investment, in general) than Charles Schwab. The Schwab Knowledge Center provides an invaluable insight into the intricacies of personal wealth accumulation. Recommended even for the seasoned stock investors.

- Service rating - 5 out of 5. Upon spending enough time studying and testing this broker, we arrived at the conclusion that it has one of the best customer support services in the business. The consultants are reachable 24/7 via all means of communication - we have found the live chat to be most suitable for handling urgent matters. All in all, we don’t have any complaints about this broker’s service qualities, which is why it got the top score.

E*TRADE

E*TRADE is another major US-based stockbroker that is known for establishing one of the first online platforms for stock trading in the said country. Originally named TradePlus, E*TRADE was founded in 1982 by William Porter and Bernard Newcomb. The broker was acquired by Morgan Stanley in the fall of 2020 and currently serves as its subsidiary. In that same year, E*TRADE was named by Benzinga, a widely acclaimed financial media outlet, the Best Brokerage for Beginners. Its operations are regulated by both SEC and FINRA; therefore, we can confidently label it an ultra-safe broker for trading stocks.

E*TRADE is another major US-based stockbroker that is known for establishing one of the first online platforms for stock trading in the said country. Originally named TradePlus, E*TRADE was founded in 1982 by William Porter and Bernard Newcomb. The broker was acquired by Morgan Stanley in the fall of 2020 and currently serves as its subsidiary. In that same year, E*TRADE was named by Benzinga, a widely acclaimed financial media outlet, the Best Brokerage for Beginners. Its operations are regulated by both SEC and FINRA; therefore, we can confidently label it an ultra-safe broker for trading stocks.

The broker offers six account options, including brokerage, retirement, and bank accounts. Stock trading here is done mostly through the Brokerage (Individual) account that also provides a host of other investment choices, such as mutual funds, options, bonds, and futures. E*TRADE and Power E*TRADE are the broker’s two proprietary trading platforms through which it affords access to over 6,000 American and international stock markets that include penny stock markets.

Prior to 2019, the broker had been charging a modest commission on stock trading but then transitioned to the zero-commission model for the US-listed stocks, ETF, and options in order to keep abreast with the competition. Those interested in trading stock options would have to pay the fee of $0.65 per contract. Similar to Charles Schwab, E*TRADE doesn’t expand its “no-commission” approach on OTC trading ($6.95 per trade), as well as big transactions and trades associated with foreign stock markets. However, should you want to deal with mutual funds, be prepared to pay the commission of $19.99 per trade, which, in our opinion, is slightly higher than that of the broker’s main competitors.

Those versatile in margin trading must know that E*TRADE also has a slightly higher margin rate (9%) than Charles Schwab and Fidelity (8.3%). Trading stock index options will cost $0.65 per contract; the commission on stock index futures goes up to $1.5 per contract, which is in line with the competition. Lastly, E*TRADE doesn’t force its users to pay the account and inactivity fees; deposits and withdrawals are also free.

Pros:

- Zero commission on US stocks;

- Intuitive and feature-packed trading platform;

- Offers a wide variety of research and stock screening tools.

Cons:

- Deposits are made only via bank transfer.

Our verdict

- Overall rating - 4.5 out of 5. We lowered the overall score of E*TRADE by half a point because of its limited deposit options and the unavailability of direct access to international stock markets.

- Commission rating - 4.5 out of 5. Although E*TRADE adheres to the general “no-commission” trend, the platform overcharges a bit on OTC and index trading and has a slightly higher margin interest rate than other top stockbrokers on this list.

- Education rating - 5 out of 5. Unlike its international counterparts, US stockbrokers, including E*TRADE, make sure to offer volumes of information that both novice and advanced traders will find useful. There is also a wide breadth of learning material about retirement and tax planning.

- Service rating - 4.5 out of 5. We reckon that the customer service on E*TRADE can be characterized as competent but somewhat slow, especially when it comes to the consultants that operate the live chat.

Fidelity Investments

When it comes to US stockbrokers, only a handful can compete with Fidelity Investments on any level, whether it’s the variety of available markets, the sophistication of trading tools, or the affordability of commissions. The firm currently has over $4.2 trillion in assets under management (AUM), which places it third after BlackRock ($8.5 trillion) and Vanguard Group ($7 trillion) on the list of the world’s largest investment management companies. It’s a company with a long history (Fidelity was founded shortly after WWII), impeccable reputation with regulators (SEC and FINRA), and universal recognition of financial media outlets - in 2021, Forbes named Fidelity Investment The Best Online Broker.

When it comes to US stockbrokers, only a handful can compete with Fidelity Investments on any level, whether it’s the variety of available markets, the sophistication of trading tools, or the affordability of commissions. The firm currently has over $4.2 trillion in assets under management (AUM), which places it third after BlackRock ($8.5 trillion) and Vanguard Group ($7 trillion) on the list of the world’s largest investment management companies. It’s a company with a long history (Fidelity was founded shortly after WWII), impeccable reputation with regulators (SEC and FINRA), and universal recognition of financial media outlets - in 2021, Forbes named Fidelity Investment The Best Online Broker.

Fidelity Investments has four types of investing and trading accounts, with Brokerage and Brokerage and Cash Management accounts being the most popular among retail stock traders. There is no minimum deposit required when opening an account, though the verification process sometimes goes at a snail’s pace.

Unlike the first two stockbrokers featured in this review, Fidelity Investments provides access to both US and international stock markets, along with nearly 500 ETFs and 4,000 mutual funds. With Fidelity, traders can speculate on 25 international stock markets and settle the trades in 16 different currencies, which certainly gives Fidelity an edge over the competition. Customers can also purchase stocks of foreign companies that are listed on U.S. exchanges using depository receipts. With the Fidelity account, they are also free to exercise margin borrowing to trade with leverage. Speaking of which, Fidelity Investments charges a very low margin rate of 4%, which is 2.6% less than the rate imposed by Charles Schwab and 3.5% less than the margin rate at TD Ameritrade, another top US stockbroker that is going to be reviewed here.

Like the two top brokers reviewed above, Fidelity Investments takes a $0 commission for trading US stocks online, regardless of the number of shares and traders, which also spreads to EFTs and options online trades. But be prepared to pay handsomely if you intend to trade on international markets. For instance, a trader will be charged $11.7 for trading a $2,000 lot of British stocks, while the fee for trading a German stock would go up to $22.8.

Pros:

- Zero-commission for US stocks;

- International markets are available;

Cons:

- Slow account verification.

Our verdict

- Overall rating - 5 out of 5. In our opinion, Fidelity Investments is the top scorer in all categories, especially since it isn’t ignoring international stock markets and people who want to trade there. Its trading platform is also one of the best we’ve seen lately.

- Commission rating - 5 out of 5. The broker earns that extra half a point to achieve the top score for having one of the lowest margin rates in the industry and not overcharging for ETFs and options trading.

- Education rating - 4.5 out of 5. Fidelity Investments provides a good selection of educational materials, including quality webinars and a demo account, though it’s accessible only from the desktop platform.

- Service rating - 4 out of 5. Although Fidelity Investments claims to have the support team on site 24/7, its responsiveness leaves much to be desired, especially during non-business hours in the United States.

Firstrade

If you don't care much for having a broker with a globally recognized brand, but would rather go with the secure platform that offers ultra-low fees, then Firstrade should be one of your primary options. This New York-based broker has been around for 36 years, during which it has mustered the customer base of over 1 million loyal traders, both from the United States and abroad. According to the latest estimates, Firstrade has around $70 billion in assets under management, which isn't overly impressive but still sufficient to put this broker in the same line with powerhouses like Charles Schwab and Fidelity Investments.

If you don't care much for having a broker with a globally recognized brand, but would rather go with the secure platform that offers ultra-low fees, then Firstrade should be one of your primary options. This New York-based broker has been around for 36 years, during which it has mustered the customer base of over 1 million loyal traders, both from the United States and abroad. According to the latest estimates, Firstrade has around $70 billion in assets under management, which isn't overly impressive but still sufficient to put this broker in the same line with powerhouses like Charles Schwab and Fidelity Investments.

Firstrade offers several account types, including international accounts for non-US customers. Given that the broker's website features the Chinese version, the majority of its international clients must come from Asia. Retail stock traders would be interested in opening a regular investing account that can be upgraded to a joint account.

The verification process here is also a bit slow; some customers reported that they had to wait for three full days for their accounts to go live. Like most US stockbrokers, Firstrade has access limited only to US markets, though it did have a deal with Taifook Securities regarding international securities trading, but, apparently, it didn't pan out. Nevertheless, the broker covers all US markets, from penny stocks to large-cap stocks. Needless to say that Firstrade affords means for OTC and ETF trading and also offers several dividend reinvestment programs on a no-commission basis. Forex, crypto, and futures traders will be disappointed with Firstrade because these markets aren't featured on the platform, along with the promised robo-advisory service.

When it comes to commissions, Firstrade has zeros written all over it: no fee is charged for stock, ETF, and options trading. Even mutual funds, for which other top brokers impose a rather hefty commission, can be dealt with at no cost. However, the margin rates are quite high, especially for the accounts with balances of less than $50,000, towards which the margin rates of 8.25% to 8.75% apply.

Balances of over $1 million are subject to the margin rate of 4.5%, which is still higher than the fixed margin rate charged by Fidelity Investments. The non-trading fees are also among the lowest throughout the industry. However, Firstrade's main disadvantages are that it has only one base currency, compared to Fidelity's sixteen, and high withdrawal fees of up to $35 if it's not done via the automated clearing house.

Pros:

- Negligible trading fees across the board;

- Availability of international accounts.

Cons:

- No access to international markets;

- The trading platform is subpar with regard to order entry and account management.

Our verdict

- Overall rating - 3.5 out of 5. Despite its super-low fees, Firstrade's score has been reduced due to its flaws like high withdrawal fees and margin rate.

- Commission rating - 4.5 out of 5. If not for those withdrawal fees, Firstrade would have gotten the top score. Nevertheless, if you are looking for "cheap as dirt" stock trading, this broker will definitely fit the bill.

- Education rating - 3 out of 5. Firstrade does have a decent choice of learning material, but it's not as broad and insightful as one might wish. The demo account is unavailable.

- Service rating - 2 out of 5. This broker doesn't offer top-level support since it has no live chat, the service isn't available 24/7, and some consultants struggled with providing a relevant response to the inquiry.

Interactive Brokers

This US stockbroker with headquarters in Greenwich, Connecticut might not be as big as Fidelity Investments since it has “only” $170 billion in total customer assets, but it’s definitely one of the most versatile when it comes to the range of financial services, especially the ones that concern stock trading. Founded in 1982, Interactive Brokers covers multiple stock markets throughout both US and international stock exchanges, including NYSE, the London Stock Exchange, and the Hong Kong exchange. Due to its international exposure, Interactive Brokers is a multi-regulated entity that is held accountable by the US Securities and Exchange Commission (SEC) as well as the Financial Conduct Authority (FCA) of the United Kingdom, and a host of other regulators, European and Asian, so we have no reason not to call it safe.

This US stockbroker with headquarters in Greenwich, Connecticut might not be as big as Fidelity Investments since it has “only” $170 billion in total customer assets, but it’s definitely one of the most versatile when it comes to the range of financial services, especially the ones that concern stock trading. Founded in 1982, Interactive Brokers covers multiple stock markets throughout both US and international stock exchanges, including NYSE, the London Stock Exchange, and the Hong Kong exchange. Due to its international exposure, Interactive Brokers is a multi-regulated entity that is held accountable by the US Securities and Exchange Commission (SEC) as well as the Financial Conduct Authority (FCA) of the United Kingdom, and a host of other regulators, European and Asian, so we have no reason not to call it safe.

Apart from stock trading, the mentioned range of trading options includes ETFs, options, Forex, cryptocurrencies, CFDs, and warrants. In addition, it incorporates as many as 23 base currencies, the highest number among the best US stockbrokers under review. In 2021, Barron’s named it The Best Online Broker, having awarded it top scores for international trading and the number of active traders, with which we fully concur.

Investors who wish to be involved with Interactive Brokers can open one of the two available accounts: IBKR Lite and IBRK Pro. The main difference between these accounts with regard to stock trading lies in the commission charged for speculating on those markets. IBKR Lite features zero commission on US-listed stocks and ETFs, while international stocks, EFTs, and options are subject to fixed pricing. Please mind that commission-free trading is available only for US-based customers. Trading through IBKR Pro implies paying a fixed or a tiered commission.

The fixed fees range from market to market: US stocks are traded at $0.005 per share, trading German stocks might cost from 0.05% to 0.12% of trade value, activities on Asia-Pacific markets will be charged 0.08% of trade value. The tiered fee structure relies on the number of shares traded in a month and can go from $0.0005 per share for US markets when trading more than 100 million shares to $0.0035 when the trading volume amounts to 300,000 shares or less.

Customers with IBKR Pro accounts get probably the best margin rates in the industry when using USD as a base currency: 1.58% base rate + 1.5% benchmark rate for loans of $100,000 or less, loans that exceed $200 million are subject to the interest rate of 0.75% + 0.3% benchmark rate. Recently, Interactive Brokers stopped charging the inactivity fee and ultimately eliminated all non-trading fees.

Pros:

- One of the widest range of financial products among the brokers on this list.

- Great trading platform with many charting and research tools.

Cons:

- A complicated fee structure.

Our verdict

- Overall rating - 4.5 out of 5. If you are looking for a variety of trading and investment products, Interactive Brokers is definitely the way to go. Its trading platform works like a charm, but the complicated fee structure was the reason why we have cut its overall score a bit.

- Commission rating - 4 out of 5. Interactive Brokers is not the cheapest broker around, but these expenses are compensated by other factors like flawless trade execution.

- Education rating - 4.5 out of 5. The platform has a very broad scope of valuable information on trading and investing, along with detailed tutorials about its functionality.

- Service rating - 3 out of 5. Customer service isn’t this broker’s strong suit as it tends to be a bit slow, but at the end of the day, the team gets the issues solved.

Merrill Edge

Merrill Edge, or Merrill, is a US brokerage firm that emerged after Bank of America (BofA) acquired the infamous investment bank Merrill Lynch that had gone bust as the result of the global financial crisis of 2008. Currently, it provides brokerage services under the BofA brand along with the bank's main investment arm. In addition to being a subsidiary of one of the biggest investment banks in the United States with a revenue of $85.5 billion, Merrill is regulated by both SEC and FINRA, which makes it one of the safest stockbrokers in the entire industry.

Merrill Edge, or Merrill, is a US brokerage firm that emerged after Bank of America (BofA) acquired the infamous investment bank Merrill Lynch that had gone bust as the result of the global financial crisis of 2008. Currently, it provides brokerage services under the BofA brand along with the bank's main investment arm. In addition to being a subsidiary of one of the biggest investment banks in the United States with a revenue of $85.5 billion, Merrill is regulated by both SEC and FINRA, which makes it one of the safest stockbrokers in the entire industry.

Being a part of a global financial institution, Merrill offers a significant scope of account options, ranging from Individual Investing account that is perfect for stock trading, to College Planning and Inherited IRA accounts. Upon opening an individual account, the customer may get engaged in the so-called "self-directed trading" across a broad range of US stocks, ETFs, options, and bonds on its state-of-the-art platform, Merrill Edge. Like most US stockbrokers, Merrill refrains from providing direct access to international stock markets.

In correspondence with the ongoing trend in the stock brokerage industry, Merrill applies zero commission on online stock and ETF speculations, void of trade and balance minimums. But keep in mind that it only relates to self-directed (individual trading) - making broker-assisted trades will cost you $29.95 per trade.

The baseline fee for trading stock options is also at $0, but the broker charges $0.65 per contract, along with transaction fees of $0.01 - $0.03, which is on par with other top US brokers. Merrill Edge requires no minimum deposit for a stock trading account, though if you want to trade on margin, there is a requirement to have at least $2,000 on balance at all times. Merrill doesn't charge any non-trading fees, including free withdrawals, though they usually take more than three business days to complete. Lastly, Merrill accepts only US residents and has USD as its only base currency, which makes this broker somewhat non-inclusive.

Pros:

- Very low trading fees;

- Represents a financial institution with a solid reputation.

Cons:

- The broker is too US-centered.

Our verdict

- Overall rating - 4.5 out of 5. Merrill is the "full package" broker that is both secure and reasonable in terms of commissions. However, it has a couple of drawdowns in the form of slow withdrawals and limitations with regard to international stock markets.

- Commission rating - 4.5 out of 5. Merrill's fee structure is clear and adequate, though its margin rate of 8.6% is slightly higher than that offered by its main competitors.

- Education rating - 4 out of 5. The broker has a good choice of materials for in-depth education, but the lack of a demo account makes us shave off a point.

- Service rating - 3.5 out of 5. We couldn't complain about the level of Merrill's customer service, but the absence of email support is weird.

Questrade

The American stock trading industry isn’t limited to the United States - Canadian brokerage firms like Questrade also have a lot to offer to their customers. The firm in question was established in 1999 and over the past two decades, gathered over $25 million in assets under management, ensured a customer base growth rate of 200,000 new accounts per year, and was also named one of the best-managed companies in Canada on nine separate occasions. The broker operates under the umbrella of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF), which leaves us no doubt that it’s a very safe stockbroker.

The American stock trading industry isn’t limited to the United States - Canadian brokerage firms like Questrade also have a lot to offer to their customers. The firm in question was established in 1999 and over the past two decades, gathered over $25 million in assets under management, ensured a customer base growth rate of 200,000 new accounts per year, and was also named one of the best-managed companies in Canada on nine separate occasions. The broker operates under the umbrella of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF), which leaves us no doubt that it’s a very safe stockbroker.

Questrade offers several account types, all gathered under the same category of self-directed accounts, with all of them providing access to such products and markets as stocks, ETFs, options, Forex, CFDs, precious metals, bonds, mutual funds, and IPOs. However, those who prefer not to make substantial initial deposits will frown upon Questrade since opening an account with this broker requires the dedication of no less than $1,000 from the get-go.

With Questrade, you can either engage in self-directed investing and manage your own portfolio of stocks while paying the fee of $0.01 per share (this fee is capped at $9.95 per trade) or request a pre-built portfolio, in which case, you would have to pay the management fee of 0.25% that is going to be reduced to 0.2% once the portfolio grows beyond $100,000, which is still considerably lower than the rate charged by the majority of brokers.

Those who prefer to trade with leverage will be charged an annual margin rate of 7%, which is close to the industry average. Trading US stock index options will cost you $2 per contract. Like most reputable stockbrokers, Questrade doesn’t charge any non-trading fees.

Pros:

- It’s not $0 commission, but Questrade’s fees won’t nibble at your account balance too much.

- Good range of account types.

Cons:

- Non-Canadians can’t enjoy all the benefits of Questrade.

Our verdict:

- Overall rating - 3.5 out of 5. Questrade is a safe broker with a good range of services and fee structure, but high deposit requirements and excessive focus on Canadian residents result in a score reduction.

- Commission rating - 3.5 out of 5. The fees charged by Questrade are far from being the highest in the industry, but $0.01 per share looks less attractive than $0 commission.

- Education rating - 3 out of 5. Questrade offers a demo account which is a plus, but its study section appears underdeveloped.

- Service rating - 4 out of 5. The broker offers superb services and customer support, but Questrade’s only downside is that the support isn’t available around the clock.

Robinhood

Robinhood Markets, or simply Robinhood, is a newly established fully digital broker that became the center of attention of financial media outlets through a series of controversies, including security breaches, the creation of the loophole that allowed for the use of limitless leverage named the “infinite money cheat code,” and its involvement in the unprecedented pump of meme stocks, commonly referred to as the “GameStop short squeeze.” It’s regulated by SEC and FINRA, though the former had initiated the investigation against the broker for failing to disclose the information about customers’ orders being revealed to other firms - the broker had to pay $65 million to settle the case.

Robinhood Markets, or simply Robinhood, is a newly established fully digital broker that became the center of attention of financial media outlets through a series of controversies, including security breaches, the creation of the loophole that allowed for the use of limitless leverage named the “infinite money cheat code,” and its involvement in the unprecedented pump of meme stocks, commonly referred to as the “GameStop short squeeze.” It’s regulated by SEC and FINRA, though the former had initiated the investigation against the broker for failing to disclose the information about customers’ orders being revealed to other firms - the broker had to pay $65 million to settle the case.

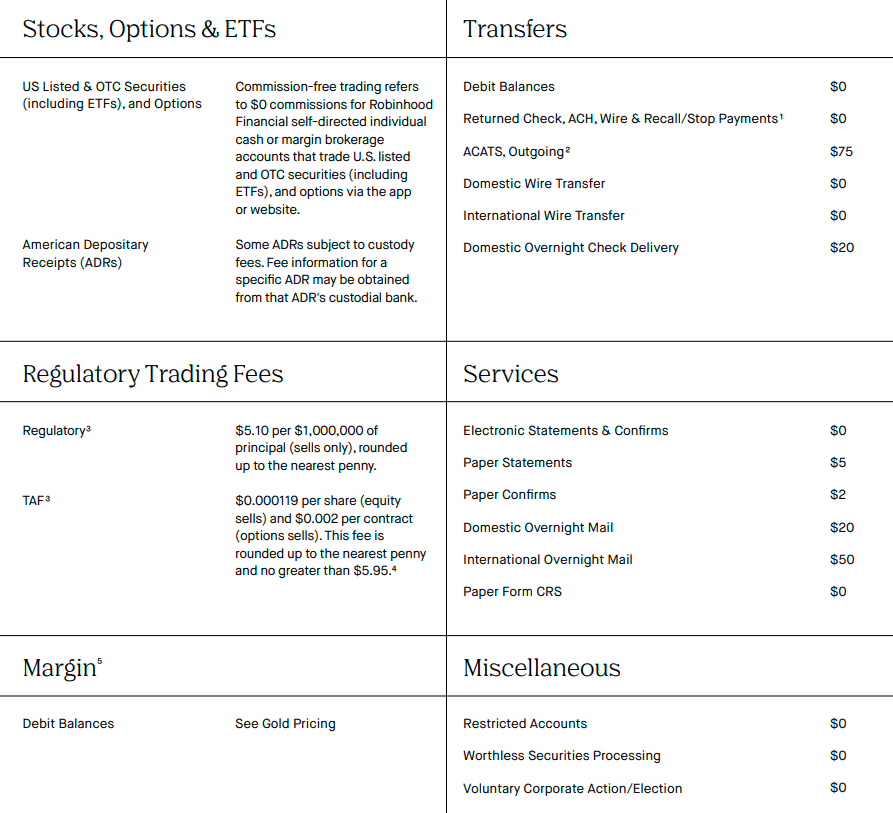

But despite all these negative occurrences, Robinhood possesses plenty of positive features that allowed us to place it on this list of the best US stockbrokers. First of all, it has a very transparent fee schedule that explains all commissions that an investor may encounter while using the application. Secondly, like most top stockbrokers in our ranking, Robinhood doesn’t charge any commission for trading US-listed stocks, ETFs, options, and other available securities. It duly warns that additional fees, like custody fees on American Depositary Receipts or regulatory trading fees, may be applied in the process of trading.

Robinhood Markets Fee Schedule

Apart from stocks, users can also speculate with options, gold, and cryptocurrencies. In addition to the traditional stocks and funds trading, Robinhood has recently introduced the option for retail traders to participate in initial public offerings, the feature that is called IPO Access. Investors with limited financial capabilities can buy fractional shares of top companies, with the cost of one fraction starting from $1. Robinhood also boasts one of the lowest annual margin rates in the industry that amounts to 2.5%.

Pros:

- Zero commissions on stock trading;

- Robust app;

- Perfect for tech-savvy young traders.

Cons:

- Robinhood’s reputation was tainted by controversies.

Our verdict:

- Overall rating - 4 out of 5. Robinhood is a solid stockbroker with immense potential, but its product range remains limited.

- Commission rating - 5 out of 5. Zero fees on stock trading and no gimmicks when it comes to extra fees - a shining example of a fully transparent stockbroker.

- Education rating - 2.5 out of 5. The educational content is limited to beginner-oriented articles.

- Service rating - 3 out of 5. Even though Robin Hood’s support service is very responsive, it doesn’t work 24/7, while the platform lacks live chat or simple phone support.

TD Ameritrade

TD Ameritrade is an accomplished US stockbroker that established its presence in the industry in the 1970s. Right now, it has $1.3 trillion in assets under management and $54.4 billion in total assets, though its revenue has been on the downslide since 2020. This broker is a subsidiary of another firm featured in our review, Charles Schwab, which carried out the acquisition in 2020. Apart from SEC and FINRA, TD Ameritrade is also regulated by the Commodity Futures and Trading Commission (CFTC), which means that trading with this broker carries no regulatory risks.

TD Ameritrade is an accomplished US stockbroker that established its presence in the industry in the 1970s. Right now, it has $1.3 trillion in assets under management and $54.4 billion in total assets, though its revenue has been on the downslide since 2020. This broker is a subsidiary of another firm featured in our review, Charles Schwab, which carried out the acquisition in 2020. Apart from SEC and FINRA, TD Ameritrade is also regulated by the Commodity Futures and Trading Commission (CFTC), which means that trading with this broker carries no regulatory risks.

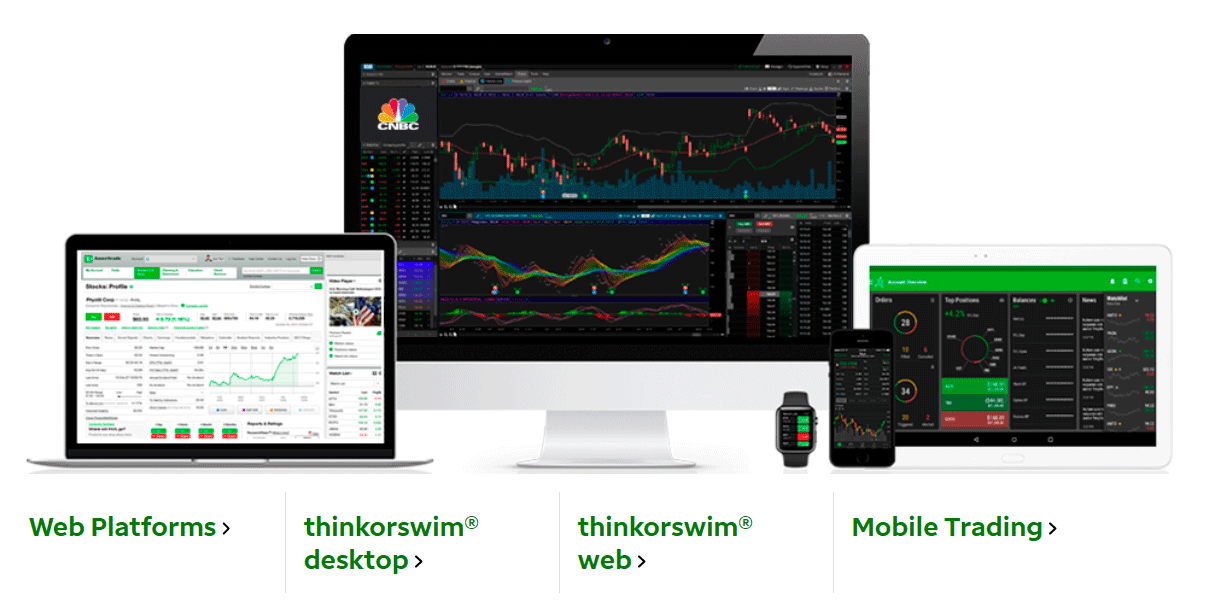

The broker in question offers a multitude of investment products that include stocks and stock splits, ETFs, options, futures (including Bitcoin futures), bonds, Forex, and cryptocurrencies. Trading can be done via three free-to-access web platforms, namely Thinkorswim desktop platform, the eponymous web-based platform, and a mobile application. New users can opt for one of the six available account types: Standard, Retirement, Education, Specialty, Managed Portfolios, and Margin, with Standard and Margin being the most suitable for stock trading.

To broker’s credit, it doesn’t limit its range of accessible markets to US stocks and allows engaging in international stock trading, as well as participation in IPOs. On top of that, TD Ameritrade incorporates a smart order routing system which ensures that traders get the best price quotes for free as well as swift order execution.

TD Ameritrade Trading Platforms

Like the majority of stockbrokers on our list, TD Ameritrade is committed to providing low trading fees across all products, while US-listed stocks and ETFs can be traded at $0 commission. However, the stock index futures commission of $2.25 per contract is high, compared to the fee of $1.5 per contract on E*TRADE and Charles Schwab. The margin rate is also higher than the competitors’ - 9.5% against 8.3% charged by Charles Schwab. As for the non-trading fees, non-US customers have to pay $25 for a wire transfer.

Pros:

- Well-designed trading platform;

- Good client support.

Cons:

- High margin rates.

Our verdict

- Overall rating - 4 out of 5. TD Ameritrade is an all-around good stockbroker with superior trading software and low fees, though the selection of stock markets is somewhat limited.

- Commission rating - 4 out of 5. As already mentioned, TD Ameritrade’s only downside is its margin rate and withdrawal fee for foreign clients.

- Education rating - 5 out of 5. A demo account, a comprehensive tutorial, and a fine selection of useful materials - when it comes to education, TD Ameritrade has it all.

- Service rating - 5 out of 5. Highly responsive custom support that speaks several languages.

Webull

Webull is a recently founded (2017) stockbroker that has close ties with Chinese businesses. Its founder, Wang Anquan, is a former technical director at Alibaba Group, a significant portion of its shares is owned by Xiaomi and Shunwei Capital, while the ownership rights belong to the Hunan-based fintech company Fumi Technology. Despite its "Asian connections”,Webull enjoys considerable popularity among US stock traders and investors since it offers high-quality trading platforms and very relaxed fees. Besides, because the broker is fully digital, opening an account requires far less time in comparison to "old-timers'' like Fidelity Investments and Charles Schwab. Webull offers only two account types: the standard Individual Brokerage account and the IRA account for retirement needs.

Webull is a recently founded (2017) stockbroker that has close ties with Chinese businesses. Its founder, Wang Anquan, is a former technical director at Alibaba Group, a significant portion of its shares is owned by Xiaomi and Shunwei Capital, while the ownership rights belong to the Hunan-based fintech company Fumi Technology. Despite its "Asian connections”,Webull enjoys considerable popularity among US stock traders and investors since it offers high-quality trading platforms and very relaxed fees. Besides, because the broker is fully digital, opening an account requires far less time in comparison to "old-timers'' like Fidelity Investments and Charles Schwab. Webull offers only two account types: the standard Individual Brokerage account and the IRA account for retirement needs.

Similar to another "young" stockbroker, Robinhood, Webull has a narrow selection of trading instruments, namely stocks, ETFs, cryptocurrencies, and options. And like nearly all brokers under review, Webull doesn't impose a commission on stock and ETF trading, though here, the options trading is also free.

But contrary to Robinhood, Webull imposes a rather high annual margin rate for stocks (7%), while its competitor charges only 2.5%. There are no minimum deposit requirements and practically no non-trading fees. Deposits are free, as well as withdrawals if done via an automated clearing house. Perhaps Webull's only drawback is that it has only one base currency - USD.

Pros:

- Rapidly developing platform with low fees and intuitive interface.

Cons:

- Relatively poor selection of trading products;

- Only one base currency.

Our verdict

- Overall rating - 4 out of 5. Webull isn't overly impressive nor disappointing - it's a solid platform with enough markets and tools for an average retail stock trader.

- Commission rating - 4 out of 5. Free stock trading has become a must for a highly-ranked stockbroker, though Webull's high wire transfer fee doesn't allow us to give it the top mark.

- Education rating - 2 out of 5. Webull's capacity for education is limited to a demo trading account.

- Service rating - 3 out of 5. One can get prompt customer support only through the message center found on the trading platforms, but other than that, Webull's customer service is below the industry standard.

Bottom line

It’s clear that US brokers are the cheapest for trading stocks and related financial products since the overwhelming majority of them adhere to the “zero commission” principle. Therefore, choosing the best US stockbroker for your investment or trading needs should depend on additional factors, like whether or not you intend to trade with leverage. In that case, you should opt for brokers with the lowest margin rates, such as Interactive Brokers or Robinhood.

But if you don’t fancy all those sophisticated trading products and look for simple and cheap spot trading, Firstrade could be the best option.

In our opinion, the only downside to most of these brokers is that they are too tailored for domestic audiences and don’t admit or impose strict requirements on non-US and non-Canadian residents, which is probably explained by high regulatory demands. But all in all, those brokers represent the best and the cheapest way to the exciting world of stock trading that can turn one’s life around or ensure financial security prior to retirement, though investors must never forget about the risks associated with speculations on financial markets and trading with leverage.