Until recently, people in Asia have been shying away from financial markets, giving preference to real estate ownership and speculation as a means for wealth accumulation. But with the looming housing crisis in China, which threatens to spread across the world, and the general improvement of access to global financial markets, the number of stock market investors in this region has been increasing steadily over the past decade. According to Statista, nearly 140 million people in China currently own stocks, not to mention the number of investors in more progressive regions like Hong Kong and Singapore.

The Far East Connections: The List of the Best Asian Stockbrokers in 2021

Below you will find the list of the finest stock brokers in Asia that were selected with regard to their reputation, the number of available stock markets, trading fees, security, and customer service. They might interest not only local traders but also those who reside in other parts of the world because all these brokers are inclusive and accept foreign clients, besides their fees might be deemed as very reasonable.

Tiger Brokers

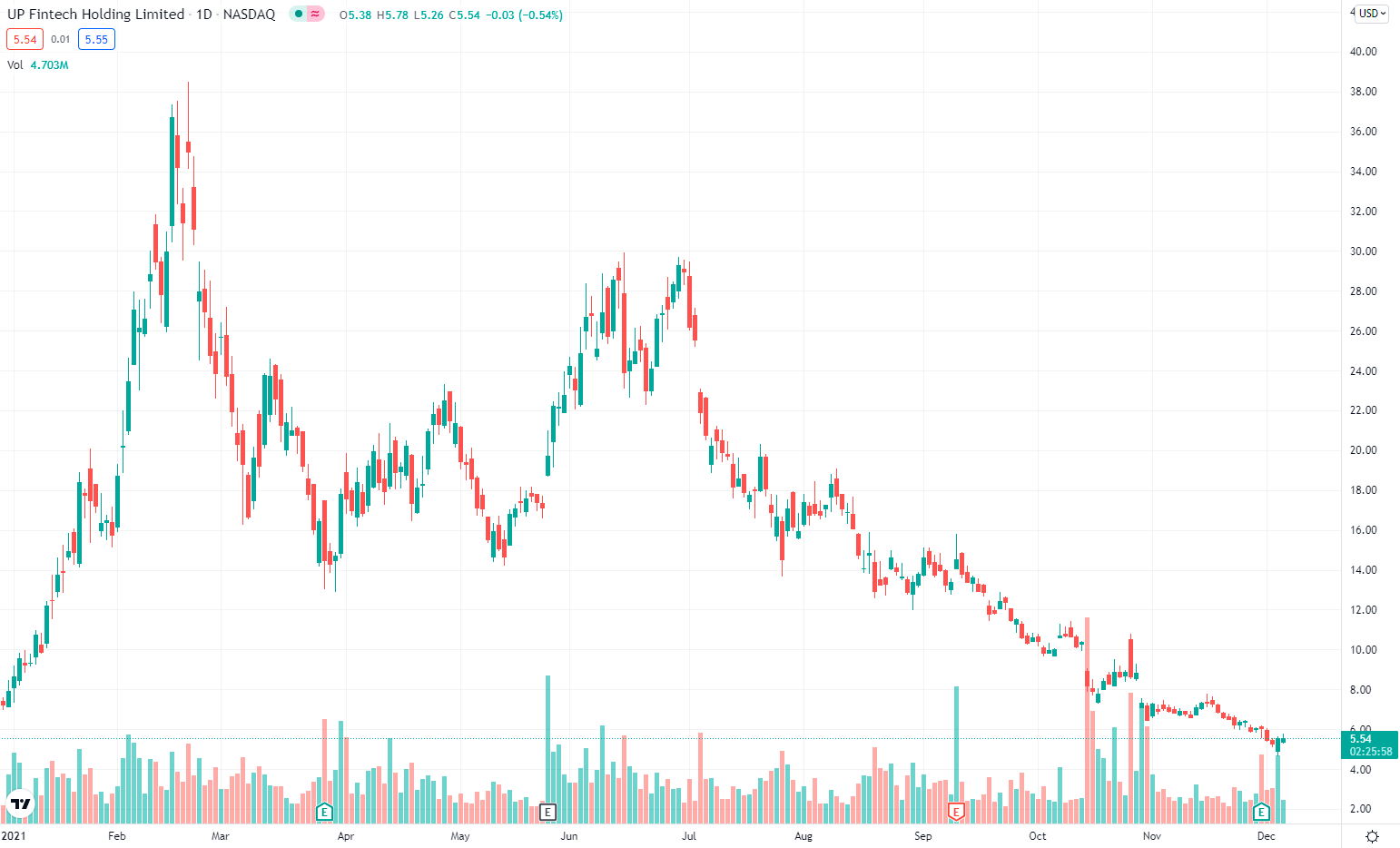

Despite the unfortunate developments for those who kept on going long even when the depicted bullish rally had climaxed, Tiger Brokers as a brokerage business has been thriving. According to the recent stats, the broker boasts an annual trading volume of nearly $220 billion and puts up quite an impressive $1.7 million trades per second.

TIGR price chart. Source: Tradingview

On the business side of things, Tiger Brokers is backed by numerous big corporations and financial services firms, such as Xiaomi Corporation, the manufacturer of consumer electronics, and Interactive Brokers, one of the leading U.S. stock brokers that we have reviewed here (здесь линк на текст о U.S. brokers). Zhen Fund, Hontai Capital, and China Growth Capital, all being major Asian venture capital firms, have also invested in the stockbroker in question.

As to regulation, Tiger Brokers holds the license from the Monetary Authority of Singapore (MAS) for its primary business purposes, but it’s also subject to regulation by the U.S. and Hong Kong financial authorities. Clients’ funds are being held in the custody of Interactive Brokers and Singapore-based DBS Bank. All these factors led us to conclude that Tiger Brokers is a very safe and reliable stockbroker.

When it comes to financial products on offer, Tiger Brokers affords access to trading stocks and ETFs, as well as options, warrants, CBBCs, futures, and a proprietary wealth management solution called “Fund Mall.” The broker under review provides access to a wide range of U.S. and Asian stock markets: U.S. stocks and ETFs, Hong Kong markets, such as HKEX, Singapore exchanges, Australian markets, and Chinese A-shares, which makes Tige Brokers the one-stop-shop for Asian stock traders.

However, unlike its U.S. peers, Tiger Brokers doesn’t use the “zero-fees” model, though its fees are very low. For instance, trading U.S. stocks and ETFs will cost from $0.005 per share, Hong Kong, Australian, and Chinese stocks are subject to the commission of 0.03% of trade value, while a 0.04% fee applies to Singaporean markets. Traders can open two types of accounts with Tiger Brokers, namely the basic Cash Account that can be upgraded to Margin Account for trading stocks with leverage of up to 4:1.

Pros:

- Solid broker with backing from reputable financial and business entities.

- Low stock trading fees.

- Access to a wide range of stock markets.

Cons:

- Lack of educational materials.

Our verdict

- Overall rating - 3,5 out of 5. If not for the mentioned absence of the education section, Tiger Brokers would have gotten the top overall score from us because, apart from this shortcoming, it’s rightfully considered one of the best stock trading platforms in Asia.

- Commission rating - 5 out of 5. Tiger Brokers offer very reasonable stock trading fees that won’t empty your account if you follow the basic money management rules.

- Education rating - 1 out of 5. There is nothing much to say; a rookie stock trader/investor who intends to open an account with Tiger Brokers should look for educational materials elsewhere.

- Service rating - 4 out of 5. Tiger Brokers has telephone customer service, an online chat, and a designated email to help clients in need. The service, however, isn’t available 24/7.

Phillip Capital POEMS

Phillip Capital is a multi-regulated stock broker that provides services under the supervision of the U.S. Commodity Futures Trading Commission (CFTC), and the U.K.’s Financial Service Authority (FSA), and Financial Conduct Authority (FCA), which obviously makes it a very safe broker for investing and trading. Besides, the broker claims to keep the traders’ capital in a segregated account in the so-called “tier-1” banks, which is another term for top-notch financial institutions.

Phillip Capital doesn’t have a very extensive user base - the total number of accounts barely exceeds 10,000 - this is explained by the fact that the broker has high non-trading fees and account requirements. Even though the broker allows commission free deposits, it charges from $25 to $50 for withdrawals via wire transfers, $25 for returned wires, and as high as $30 if a deposit check had bounced.

The broker also has the requirements regarding the minimum account size that must be no less than $5,000 for both U.S. and foreign-based customers. The minimum deposit is $200. In addition, closing the account will cost a client up to $100, and the inactivity fee is also quite steep. Therefore, Phillip Capital mightn’t be suitable for average retail traders and investors, but it surely provides high-level financial services for institutional investors and traders that handle significant capital.

The broker affords access to 189 markets, which includes a broad number of U.S. and international stock exchanges, such as the Australian Securities Exchange (ASX), the Stock Exchange of Hong Kong (HKEX), and the London Stock Exchange (LSE), among others - 16 exchanges in total. The list of other financial products includes futures and options.

Retail traders who want to have access to a wider range of financial products with lower entry barriers and cheaper fees should opt for Phillip’s Online Electronic Mart System (POEMS), the Singapore-based stock broker and subsidiary of Phillip Capital Group that has won multiple awards for its services. On this platform, traders will have access to all stock exchanges listed above, along with warrants, mutual funds, CFDs, and bonds. The broker also offers a proprietary online trading platform - POEMS 2.0 - that is packed with analytical tools and ensures seamless order execution.

When it comes to trading fees, POEMS offers a tiered structure, depending on the account type (Starter, Premier, or Privilege) and tradable markets. Trading on U.S. stock markets will cost a flat fee of $3.88, $2.88, and $1.88, respectively. A flat 0.08% commission applies to all Singaporean stocks regardless of the account type. Dealing with Hong Kong markets will cost from 0.08% to 0.05%. Non-trading fees on POEMS are very low, especially in comparison with those charged by Phillip Capital.

Pros:

- Reputable broker.

- Broad access to U.S. and international markets.

- Good trading software.

Cons:

- High entrance barrier.

- Non-trading fees can put a burden on the account.

Our verdict

- Overall rating - 3.5 out of 5. Phillip Capital is a versatile brokerage firm with a solid reputation and a plethora of financial products to offer. However, it’s tailored for a more financially capable clientele, though POEMS will satisfy the needs of mid-tier stock traders and investors.

- Commission rating 3 out of 5. We won’t be sketching the truth if we say that Phillip Capital imposes high fees, especially the non-trading ones, though when it comes to POEMS, the commissions are not too much high.

- Education rating - 4,5 out of 5. POEMS offers a broad range of educational materials that include seminars, podcasts, video tutorials, along with a decent range of research tools and screeners. POEMS also provides a demo account.

- Service rating - 4 out of 5. Both Phillip Capital and POEMS provide responsive and competent customer service, but the latter has the advantage in the form of live chat that could be very useful at times.

DBS Vickers Securities

Even though the core of DVS’s customer base is comprised of Singaporeans, the broker accepts traders from all over the globe without discriminating against them in terms of commissions and minimum deposits. Trading stocks with DBS Vickers securities requires an account that one can open for free. There are five account types: Cash, Cash Upfront, Young Investor, the Central Provident Fund (CPF), and the Supplementary Retirement Scheme Accounts (SRS). The Cash account covers all needs of a stock trader and offers better trade settlements for those who have an account at the DBS Bank or the POSB Bank.

The Singapore-based customers of the said bank who use the iBanking service can benefit from opening the Cash Upfront account that provides the lower (0.12%) fee for cash upfront trades, which is definitely one of the lowest in this region. The Young Investor account will be interesting to people aged between 19 to 20 who want to start building wealth through stock trading. For such investors, the broker also provides an educational course called SGX Academy. DVS has no minimum deposit requirements and doesn’t charge a deposit fee. The withdrawal fee, however, amounts to 50 Singapore dollars, which is roughly $37.

DBS Vickers Securities has a rich assortment of investment options which includes stocks, ETFs, real estate investment funds, depository receipts, warrants, callable bull/bear contracts, and daily leverage certificates - probably the best choice of markets among all stock brokers on our list. In case of stocks, DVS becomes a gateway to all major exchanges and stock markets in the United States, Canada, the United Kingdom, Australia, and Japan, as well as local markets. Contrary to many other stock brokers, DBS Vickers Securities provides free live quotes on all stocks, except the U.K. (15-minute delay), Australian, and Japanese (20-minute delay) markets.

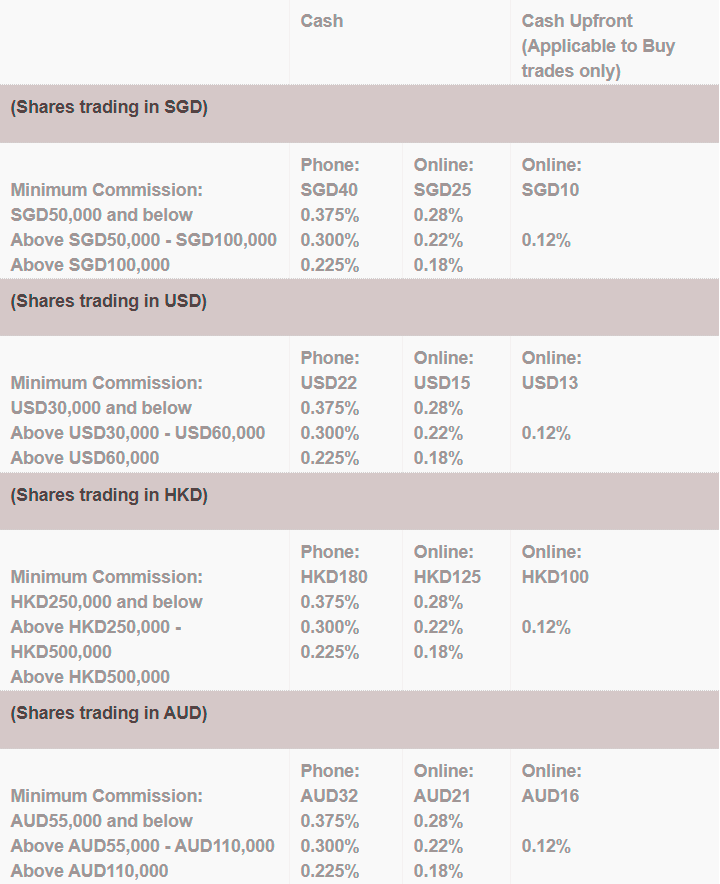

Now, to the matter of trading fees: DBS Vickers Securities has an extensive fee ladder for all types of stocks and the currencies in which they are traded. By the way, the broker has seven base currencies: SGD, USD, HKD, AUD, EUR, GBP, and JPY.

DBS Vickers Securities Comission Charge

The commission also depends on whether the user trades on their own accord or relies on the broker’s advisors. For instance, the commission of 0.18%, and the minimum of $25, applies to U.S. stocks that are traded online, but if the same stocks are being traded over the phone and with broker’s assistance, the fee goes up to 0.45%, and the minimum also increases to $35. The average commission for Singapore markets stands at 0.26%. Canadian markets are subject to the highest fees that amount to 0.5% (online) and 1% (phone).

Pros:

- The broker is the fully-owned subsidiary of a major Singaporean bank.

- Good choice of account options and stock markets.

- A wide range of base currencies.

Cons:

- A complicated fee structure; some markets are more expensive in terms of fees than the industry average.

Our verdict

- Overall rating - 3,5 out of 5. DBS Vickers Securities is definitely not a stock broker with the cheapest services around, but its fees are considerably lower than those at Phillip Capital. Apart from that, it’s an all-around great brokerage firm that can meet the needs of all investor groups.

- Commission rating - 3 out of 5. The trading commissions here aren’t the lowest on the global brokerage market, especially considering that U.S. brokers now adhere to the “zero-fee” concept. But we reckon that DVS doesn’t charge more than other top Asian brokers, though strict money management must be applied when trading with DVS.

- Education rating - 3 out of 5. The educational section on DVS’s official website is limited to the glossary of investment terms, some guidelines for investment tools, and the guide to the broker itself, created for new users. Not a lot to choose from, but still more insightful than the education options at Tiger Brokers.

- Service rating - 4 out of 5. DBS Vickers has an entire section on its website dedicated to help & support that aims to solve all possible issues that may arise when trading stocks with this broker. Their response time, however, isn’t the fastest among the competitors.

FSMOne

In the question of regulation, FSMOne is a fully licensed stockbroker that possesses the Capital Market Services license from the Monetary Authority of Singapore (MAS) - its international divisions are regulated by financial authorities in corresponding countries.

Newcomers are two account types: the Personal Account and the Beneficiary Account - each one is free and rather easy to set up. However, the broker doesn't allow the bankrupt individuals (for obvious reasons) to open an account, as well as the citizens of the United States due to regulatory and taxation reasons. Other non-Singapore investors can apply for an account, though if approved, it will be registered as a separate account at one of its foreign divisions, most likely the Hong Kong one. There are minor restrictions for the citizens of Ireland, who can't get involved with Legg Mason Value Fund, and those of Canada - they can't invest funds associated with Franklin Templeton.

FSMOne doesn't have the minimum deposit requirement and doesn't charge the deposit fee - the deposits can be made in as many as eleven currencies, including New Zealand dollar (NZD) and Swiss Franc (CHF).

Deposits can be made via wire transfers, check payments, bank drafts, and also using payment services like Payee or PayNow, which is a very good option for international customers. As for the withdrawals, FSMOne also doesn't impose any commissions but encourages to carry out these operations through its proprietary payment outlet - FSM Cash Solutions, which ensures the fastest payouts.

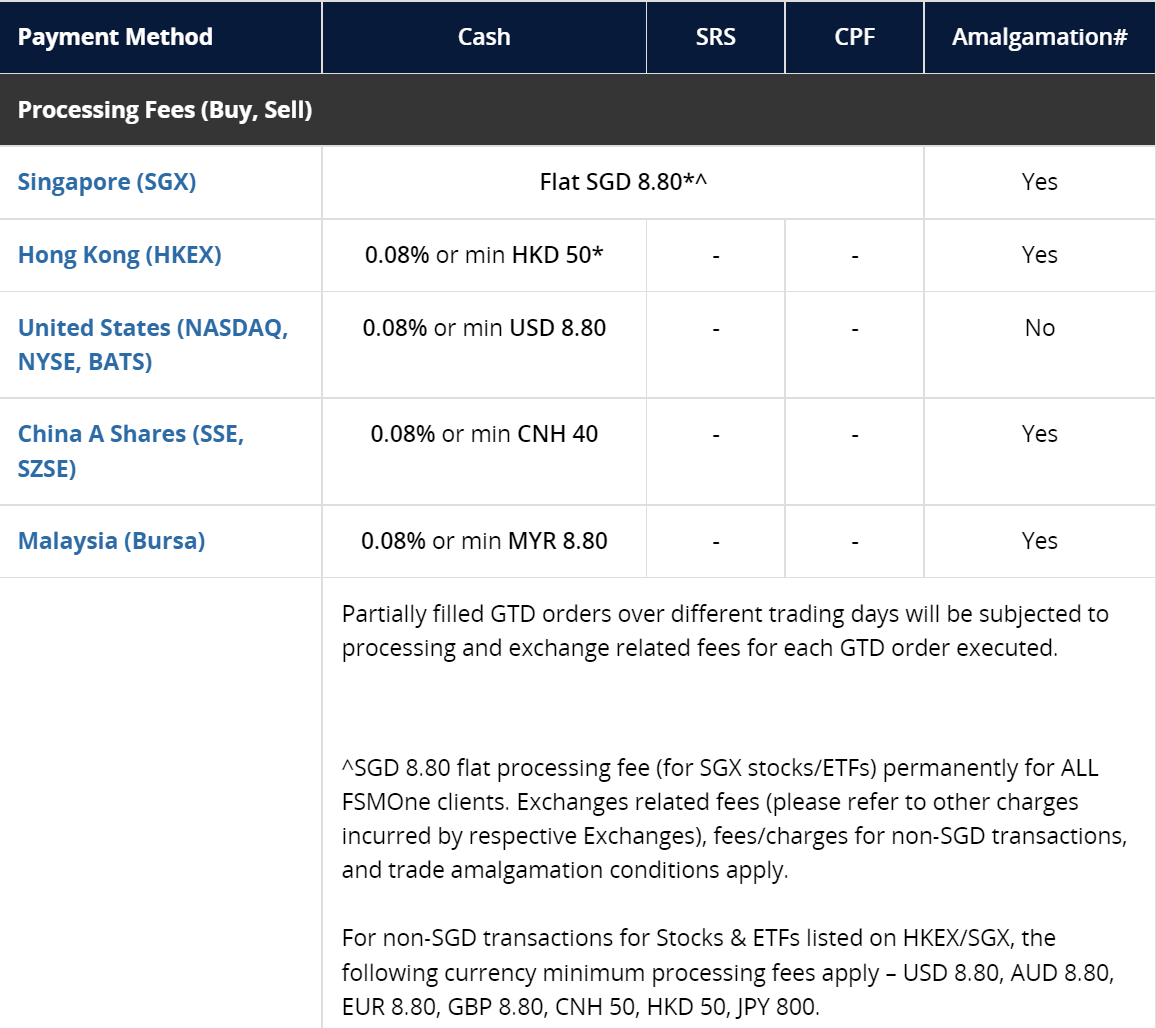

FSMOne Comission Charge

As for the stock trading fees, FSMOne is one of the most affordable Asian stock brokers as it charges a flat commission of 0.08% across all exchanges and markets, except for the local ones - for Singapore-listed stocks, the flat fee of 8.80 SGD applies, which is similar to the minimum fee for stock trading on other markets. FSMOne also refrains from charging the platform fee, though numerous other fees, such as the exchange clearing fee of 0.0325% on contract value for Singapore exchange or the SEC fee of 0.00051% for U.S. stocks might take their toll on a trader's account.

Pros :

- Good range of accessible stock markets.

- One of the lowest trading fees among Asia-based brokers.

- Open to foreign investors.

Cons:

- Somewhat mediocre trading platform in terms of charting and screening.

Our verdict

- Overall rating - 5 out of 5. In all candor, FSMOne is excellent in almost every aspect, from the ease of account opening to trading and non-trading fees. It's surely one of the best stock brokers for retail traders and investors across the entire region.

- Commission rating - 5 out of 5. FSMOne offers the fee structure that is the closest to its U.S. counterparts, or even better than some of them, because this broker refrains from charging non-trading fees, which other stock brokers tend to abuse.

- Education rating - 4,5 out of 5. FSMOne has a very insightful research/education section on their website that provides valuable information on market developments, offers investment ideas, and contains interesting blogs and webcasts.

- Service rating - 4.5 out of 5. The level of customer service provided by this broker is also beyond reproach. There is a live chat that is active 24/7, as well as consultants available via the phone or email. One can also make an appointment with the broker's in-house financial advisor, who would offer their take on the client's current portfolio.

Monex Boom

You won’t find a confusing multitude of account types here - there is only one multi-currency account that can be created by anyone, regardless of their place of residence, which makes Monex Boom probably the most inclusive broker in Asia. There are no deposit fees or limits regarding a sizable minimum deposit. Depositing it can be carried out via online or phone banking, bank transfer, cheque, ATM, and wire transfer. However, all these options are available to Hong Kong residents who deposit in HKD. Deposits from foreign banks accounts can be made only via wire transfer or bank draft.

Once the account registration is complete, traders get unrestricted access to 12 markets: Hong Kong (direct market access), the United States and Japan (straight-through processing), China, South Korea, Singapore, Australia, Taiwan, Thailand, Philippines, Malaysia, and Indonesia.

Trades that are done in foreign currencies are converted to the settlement currency automatically and at a very low fee. Monex Boom charges a flat commission of 0.18% per order or the minimum of 88 Hong Kong dollars.

Pros:

- Easy registration.

- Low trading commission.

- Plenty of deposit/withdrawal options.

Cons:

- Trading and research tools need improvement.

Our verdict:

- Overall rating - 4 out of 5. Monex Boom isn’t overloaded with features, tools, and financial products on offer, which we deem to be appealing about this broker. It’s focused on stocks and, judging from our experience, provides top-notch services.

- Commission rating - 5 out of 5. Low trading commission, no hidden charges or predatory non-trading fees - everything what a retail stock trader wants.

- Education rating - 3 out of 5. Monex Boom does have an education section, but it isn’t broad or insightful enough to satisfy an up-and-coming stock trader's craving for knowledge.

- Service rating - 4 out of 5. Monex’s customer service is fast, reliable, and competent - many consultants speak several languages. However, the platform definitely lacks live chat.

Bottom line

The brokerage industry in Asia has been developing in leaps and bounds over the past couple of decades, which resulted in the emergence of a multitude of firms, five of which deserved a place on our list of top stock brokers. All these brokers offer top-tier services for both retail and institutional investors, as well as access to a abundance of interesting stock markets. The commissions charged by these brokers are very reasonable, and their openness to foreign investors deserves separate praise and speaks in their favor when compared to the U.S. brokers that appear to be too isolationistic.

As always, we won’t be naming a single best broker, though Monex Boom and FSMOne deserve a special mention for their fee schedule and user-friendliness. It’s obvious that the brokerage tradition in Asia is still in development, but the gap between Asian brokers and their American or international counterparts isn’t too great, to be frank. Asian stock markets offer a fair share of profit-making opportunities, and these brokers will certainly help to capitalize on them.