Market sentiment shifted in favour of the yen after the release of key economic indicators from Japan. Wage growth data confirmed expectations that the Bank of Japan (BoJ) may continue tightening monetary policy.

Additionally, the January Japan Services Business Activity Index was revised upwards to 53.0 points from the preliminary estimate of 52.7, further strengthening confidence in the Japanese economy and supporting the yen.

Externally, JPY received additional support from a softer US dollar. The recent decision by the US to delay higher tariffs on Mexico and Canada, along with less severe trade tensions with China than initially feared, eased some market concerns, leading to a decline in USD demand.

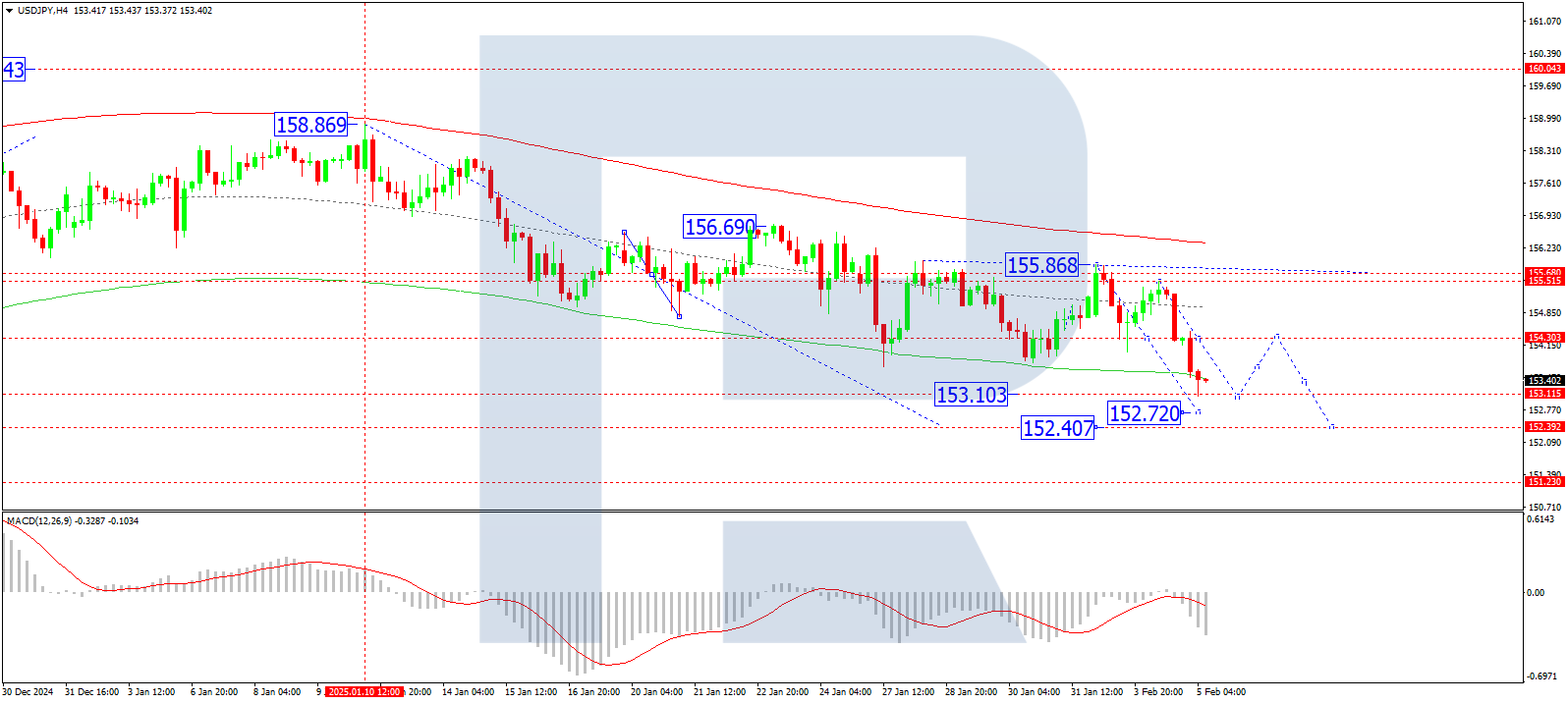

On the H4 chart, USD/JPY consolidated around 154.30 before breaking downwards, forming a decline wave to 153.10. A corrective move towards 154.30 is expected today. Once this correction is complete, a new wave of decline could target 152.70, with the potential for further movement towards 152.40. The MACD indicator supports this scenario, with its signal line below zero and sharply downwards, confirming the bearish trend.

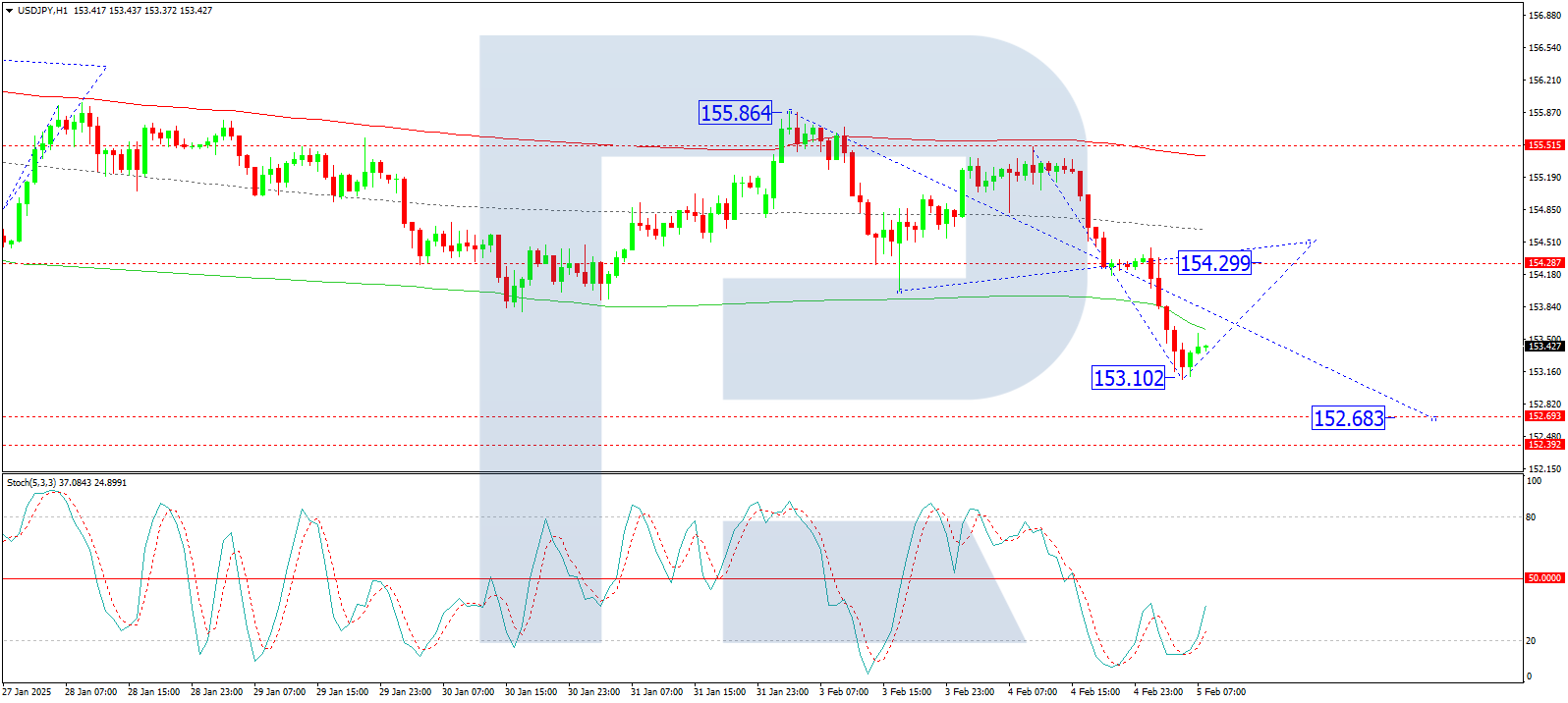

On the H1 chart, the pair completed a local downward wave to 153.10 and is currently consolidating above this level. If the pair breaks upwards, a correction towards 154.30 could follow. However, another decline is expected after this correction, initially targeting 153.70. The Stochastic oscillator confirms this scenario, with its signal line below 20 and pointing upwards, suggesting a short-term corrective move before resuming the downtrend.

The Japanese yen is gaining support from strong domestic economic data and further BoJ monetary tightening prospects. Meanwhile, a weaker US dollar adds downward pressure on USD/JPY. While a short-term correction towards 154.30 is possible, the overall trend remains bearish, with key downside targets at 153.70, 152.70, and 152.40. Investors will closely monitor further economic developments and BoJ signals for additional clues on the yen’s trajectory.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.