The USD/JPY pair dipped to 155.60 on Wednesday as investors adopted a cautious stance ahead of the Federal Reserve’s interest rate decision. With uncertainty looming, market participants are refraining from taking excessive risks.

Key market influences

The Fed is widely expected to keep interest rates unchanged. However, given the persistent pressure from US President Donald Trump, who continues to call for rate cuts, how the central bank navigates this decision is particularly interesting.

Previously, the yen faced downward pressure as demand for safe-haven assets diminished due to Trump’s escalating tariff threats. However, the currency is still supported by developments within Japan’s domestic economy.

The minutes from the Bank of Japan’s (BoJ) December meeting revealed a measured approach to monetary policy adjustments. The central bank remains cautious in responding to inflation trends while factoring in wage growth and global economic risks.

Despite this caution, the BoJ has already raised interest rates and revised its inflation forecasts upwards, sending a strong signal that further rate hikes remain possible. This outlook serves as a key supportive factor for the yen.

Technical analysis of USD/JPY

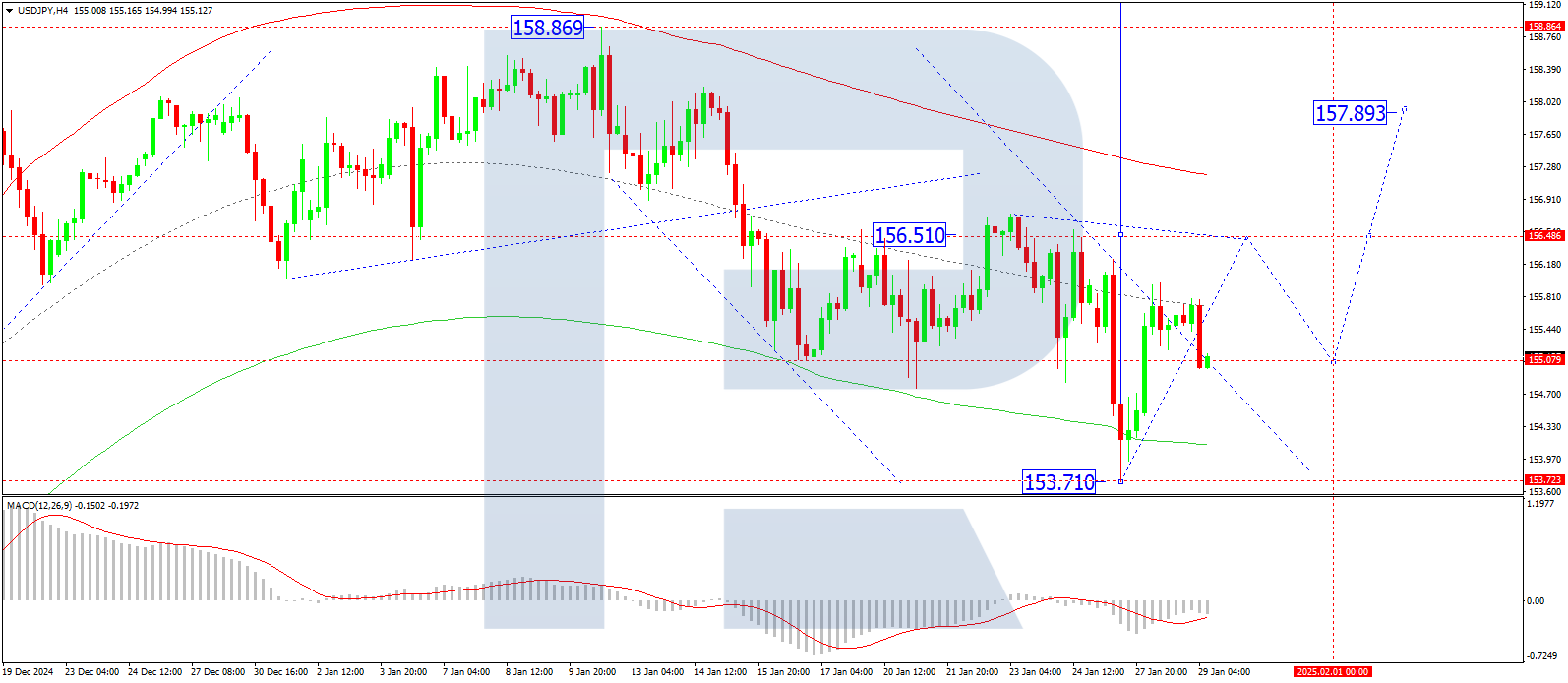

On the H4 chart, USD/JPY is forming a consolidation range above 155.00. If the pair breaks upwards from this range, the next target is 156.50, indicating a potential continuation of the growth wave. After reaching this level, a corrective move back to 155.00 may follow. The MACD indicator supports this scenario, with its signal line positioned below zero but pointing upwards, suggesting bullish momentum.

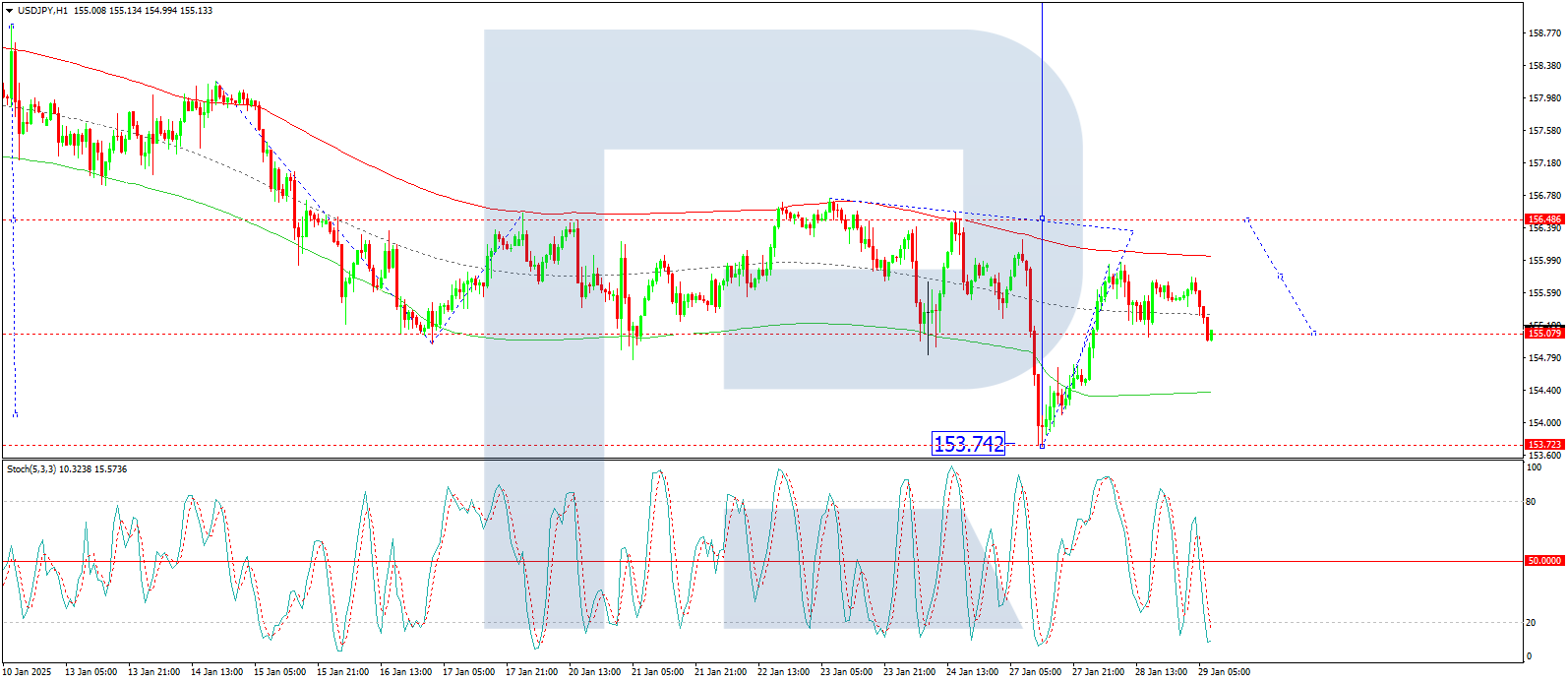

On the H1 chart, the pair recently reached a local target at 155.95 before correcting to 155.00. The market is now poised for another growth wave, with an expected target at 156.50. The Stochastic oscillator confirms this outlook, with its signal line below 20 and trending upwards, indicating potential bullish movement.

Conclusion

The Japanese yen is holding steady amid a cautious market environment, with investors awaiting the Federal Reserve’s policy decision. While external risks persist, the BoJ’s recent rate hike and upward inflation revisions support the yen’s longer-term outlook. Technical indicators suggest a possible short-term rise in USD/JPY towards 156.50, followed by a corrective pullback. However, broader movements will be dictated by the Fed’s policy stance and further developments in US trade policy.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.