The price of gold is climbing towards $2351.00 per troy ounce on Tuesday. After several days of fluctuation within a sideways range, this increase is significant. The rise is attributed to the localised weakness in the US dollar as the market eagerly anticipates the release of key US inflation data at the end of the week, particularly the Core PCE indicator on Friday. This data could provide more insight into the Federal Reserve's timeline for potentially lowering interest rates.

Significant moves in gold prices are expected once the Fed's rate intentions become clearer. Currently, the Fed's communications on this topic have been vague, leaving the market without a full understanding of the future direction. Short-term futures contracts on gold are leaning towards a positive outlook, indicating market optimism about an improvement in the Fed's stance.

The minutes from the previous Fed meeting, released last week, highlighted that policymakers are still considering rate hikes, driven by the inflationary environment, which is generally unfavorable for gold.

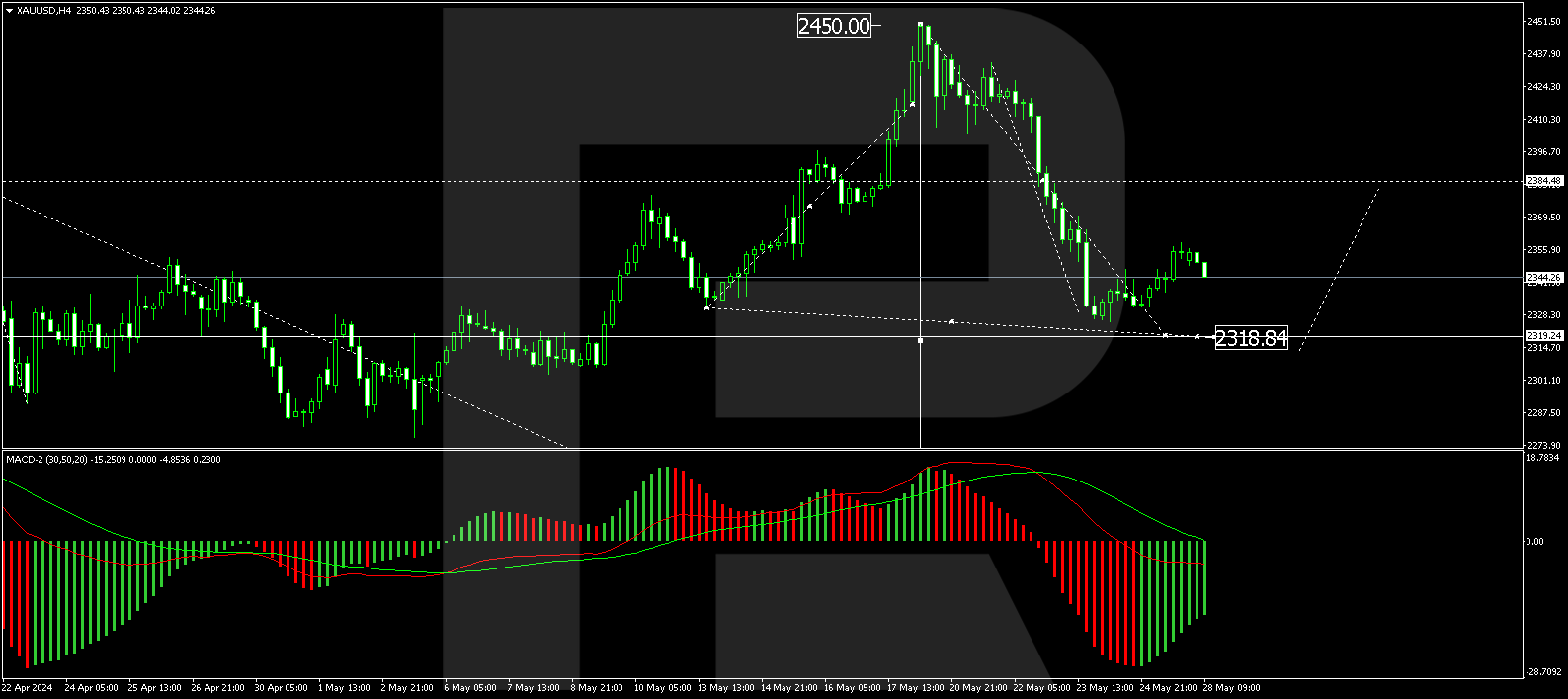

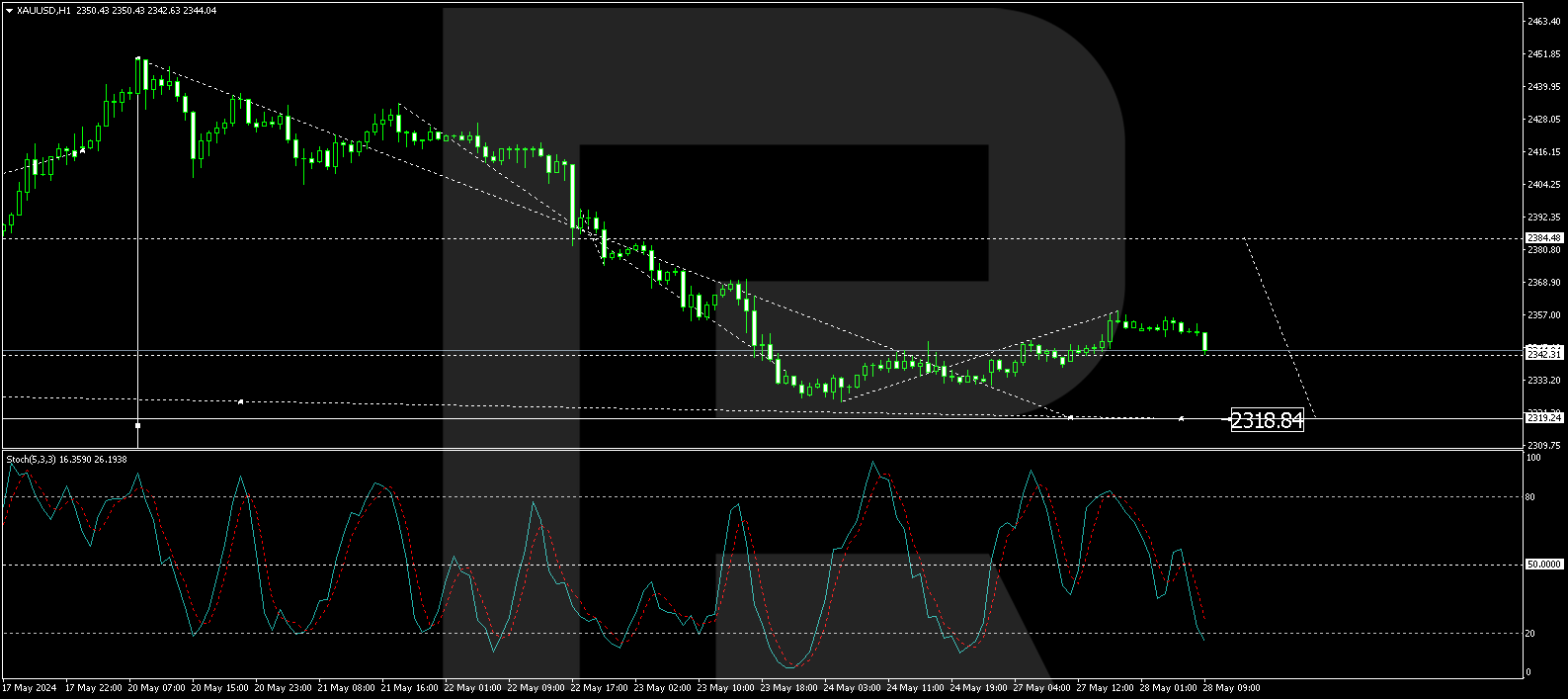

Technical Analysis of XAU/USD

On the H4 chart of XAU/USD, a second downward impulse to the 2340.00 level has been formed. Today, a correction to 2358.50 has been executed. A downside move to 2341.44 is expected, where a consolidation range may form. If the price breaks upwards from this range, further correction towards 2384.80 could be considered. Conversely, a downward breakout could open the potential for a decline to 2318.80, the first target of the decline wave. This scenario is technically supported by the MACD indicator, with its signal line below zero and pointing strictly downwards towards new lows.

On the H1 chart, a decline to 2325.40 has been executed, followed by the formation of a growth structure to 2342.31. A consolidation range has formed around this level, with a correction wave to 2358.50 starting with an upward exit. Today, a decrease to 2342.31 (testing from above) has been executed. The new consolidation range is practically outlined. A downward breakout from this range could lead to another downward impulse to 2318.85. Further development towards 2384.50 is possible if the price breaks upwards, continuing the correction to 2384.85. Afterward, a decline along the trend to 2318.85 is likely. This scenario is technically confirmed by the Stochastic oscillator, with its signal line having broken through 50 and continuing its decline to 20.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.