GBP/USD surged to a one-and-a-half-month high near 1.2592, taking advantage of a weaker US dollar and improved investor sentiment.

The pound found support from positive UK GDP data released last week, which reassured investors about the economy’s resilience despite external uncertainties. The UK economy grew by 0.1% in Q4 2024, reinforcing confidence in the pound’s stability.

However, challenges remain. Slow growth in the second half of 2024, rising inflation, high mortgage rates, and elevated debt levels still threaten the economic outlook.

Externally, GBP/USD benefitted from a weakening US dollar as fears over aggressive US trade tariffs on Canada and Mexico eased. Investors now view the White House’s tough rhetoric as a negotiation tactic rather than an immediate policy shift, reducing market uncertainty.

With US markets closed today, no significant economic data is expected from the US. Meanwhile, the UK macroeconomic calendar will be active this week with the following releases:

- Tuesday: UK unemployment data for December

- Wednesday: UK inflation data for January

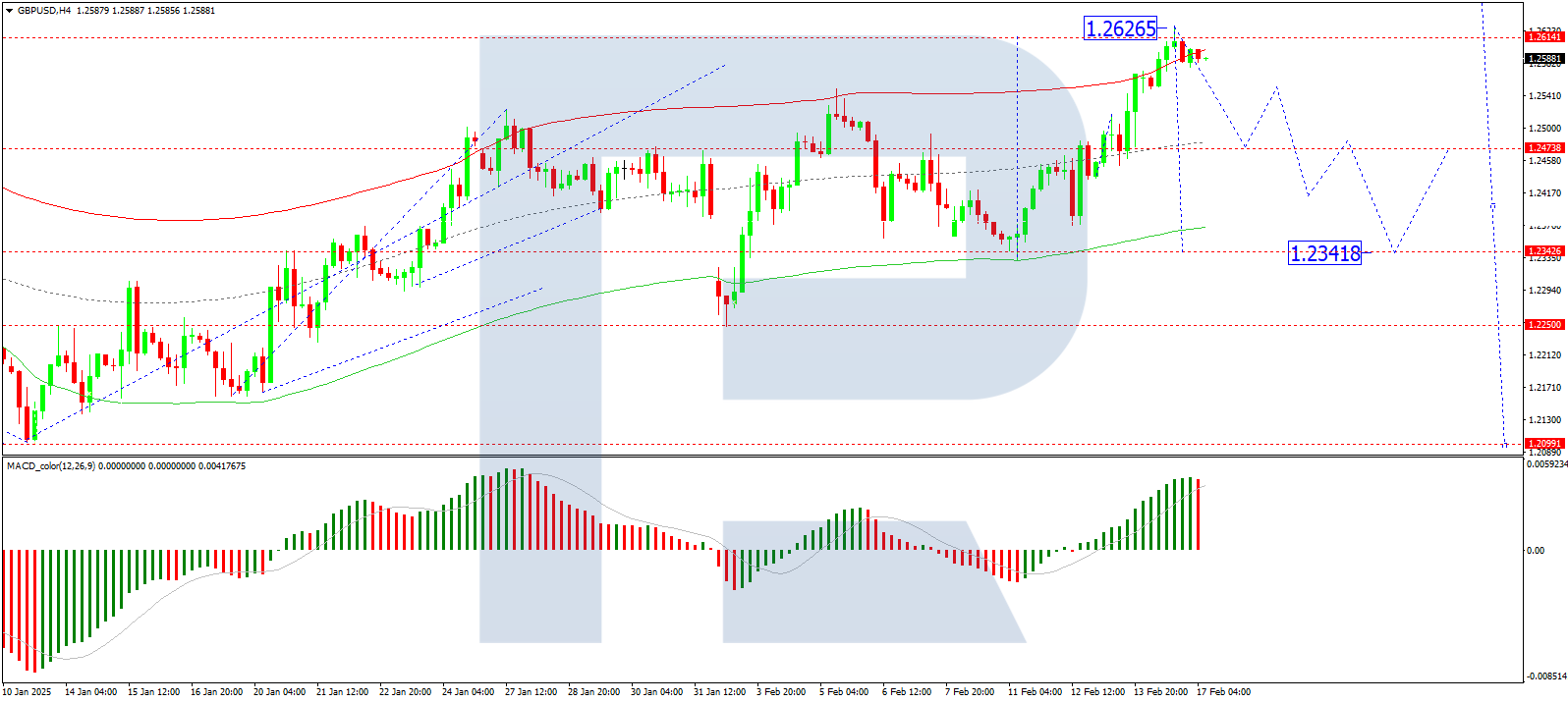

On the H4 chart, GBP/USD completed a growth wave towards 1.2626 and is now forming a consolidation range below this level. A downward breakout is expected, leading to a correction towards 1.2342. After reaching this level, a new growth wave could resume towards 1.2474. The MACD indicator supports this scenario, with its signal line above zero but now exiting the histogram zone, indicating a potential move to new lows.

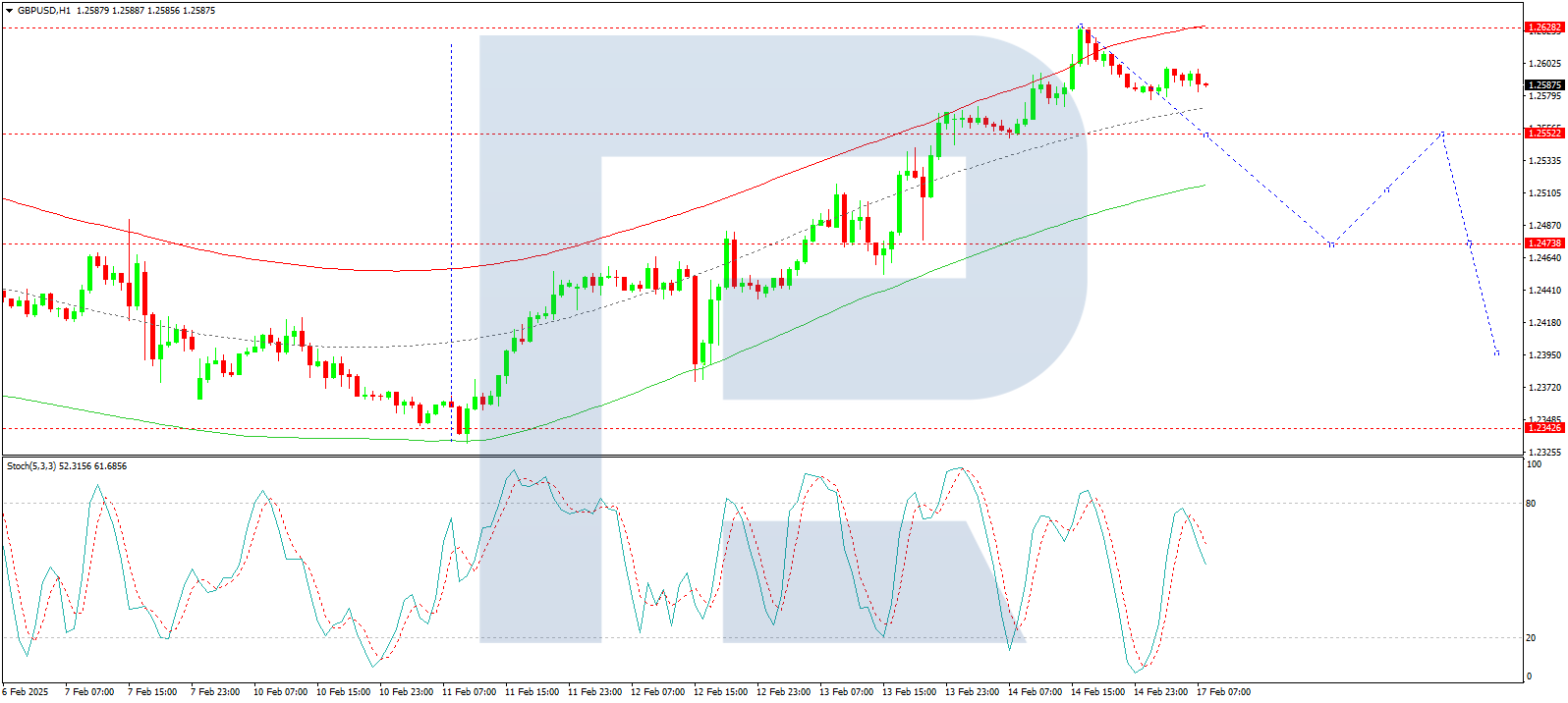

On the H1 chart, GBP/USD is developing its first downward structure, initially targeting 1.2555. A consolidation range is likely to form around this level. If the pair breaks downward, the next target will be 1.2474. The Stochastic oscillator confirms this bearish outlook, with its signal line below 80 and sharply downward towards 20, suggesting increasing downside pressure.

GBP/USD has capitalised on a weaker USD and positive UK economic data. However, technical indicators point to a potential correction, with downside targets at 1.2555, 1.2474, and 1.2342. Upcoming UK employment and inflation data will be critical in determining the next move for the pound. While the overall trend remains bullish, short-term corrections are likely before another upward push.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.