EUR/USD surged to 1.1044 on Wednesday and continues to climb, supported by mounting pressure on the US dollar amid escalating trade tensions.

Trade war escalation fuels EUR/USD rally

The US dollar came under renewed pressure after President Donald Trump approved sweeping new tariffs, signalling a deepening of the trade war. China now faces tariffs of 104%, prompting a strong response from Beijing, which pledged to defend its economic interests to the very end. Market sentiment has deteriorated further due to the lack of progress in trade negotiations despite ongoing discussions among global economic leaders. Investors fear a prolonged global trade conflict could push the US economy into recession, forcing the Federal Reserve to accelerate interest rate cuts. The White House appears committed to its strategy, even at the cost of a potential recession. At present, market participants have priced in a 100-basis-point rate cut by the Fed by the end of 2025 – double the 50-bps expected just a month ago. Attention now turns to the minutes of the previous Fed meeting, which are due for release today. Investors hope these will reveal the regulator’s future steps, although expectations remain modest, given the Fed’s delicate balancing act between tackling inflation and addressing the risks associated with economic slowdown.

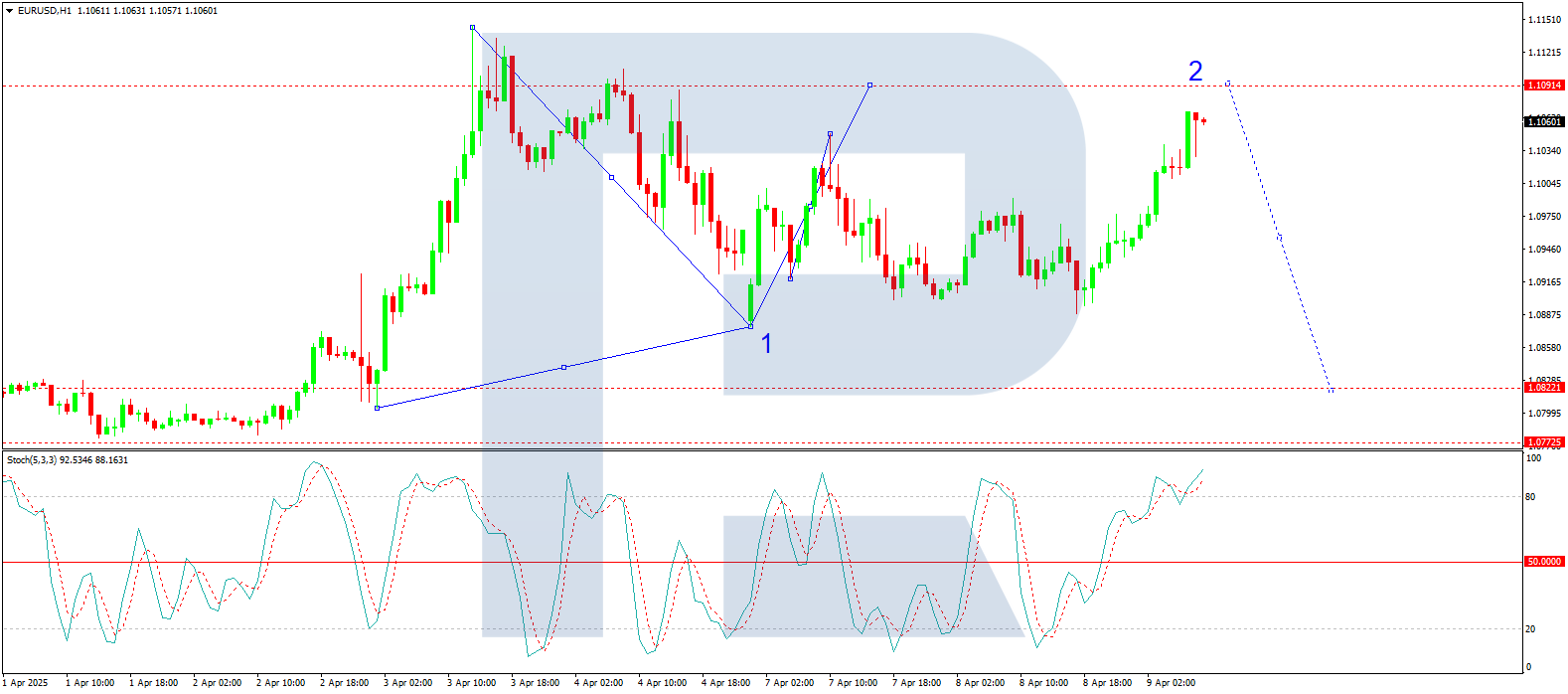

Technical analysis of EUR/USD

EUR/USD completed a downward wave to 1.0877. A correction is now likely to develop, with a potential rise towards 1.1090. A consolidation range is forming around 1.0984; a downward exit from this range would confirm a bearish scenario. The first downside target in this case would be 1.0822. The MACD indicator supports this view, with its signal line above zero but turning decisively downwards, suggesting the potential for a deeper decline. On the H1 chart, EUR/USD continues to build a correction wave towards 1.1090. The third leg of this wave is currently forming, with 1.1076 as the immediate target. After reaching this level, a pullback to 1.0982 (as a test from above) cannot be ruled out. Beyond that, the market may resume its upward move towards 1.1090. The Stochastic oscillator confirms this outlook, with its signal line above 80 and preparing to decline towards 20, indicating a near-term pullback before further growth.

EUR/USD remains supported by the deteriorating trade backdrop and rising expectations for aggressive Fed rate cuts. While technical indicators point to a likely correction, the broader uptrend remains intact as long as trade tensions persist and recession fears weigh on the US dollar. Key levels to watch include 1.0982 for potential support and 1.1090 as the short-term resistance target.