The foreign exchange market, or Forex, is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. For both novice and experienced traders, navigating this complex market can be challenging. This is where Forex advisors, also known as Forex experts or trading robots, come into play. These automated systems or professional traders can help you execute trades, manage risk, and optimize your trading strategy. However, with countless Forex advisors available, choosing the right one can be daunting. In this article, we’ll explore how to select the best Forex advisor for your needs, using insights from Forex Expert Advisors Rating.

What is a Forex Advisor?

A Forex advisor is a tool, software, or professional service designed to assist traders in making informed decisions in the Forex market. There are two main types:

-

Automated Forex Advisors (Expert Advisors or EAs): These are algorithmic trading systems that execute trades automatically based on pre-defined criteria. They operate 24/7, eliminating the need for manual intervention.

-

Human Forex Advisors: These are experienced traders or analysts who provide personalized advice, manage accounts, or offer trading signals.

Both types have their pros and cons, and the choice depends on your trading style, goals, and level of expertise.

Key Factors to Consider When Choosing a Forex Advisor

1. Performance Track Record

-

Why It Matters: The performance track record of a Forex advisor is one of the most critical factors to consider. It provides a historical snapshot of how the advisor has performed under various market conditions. While past performance is not a guarantee of future results, it offers valuable insights into the advisor’s reliability and effectiveness.

-

What to Look For: When evaluating performance, look for consistency over a long period rather than short-term gains. Key metrics to consider include:

-

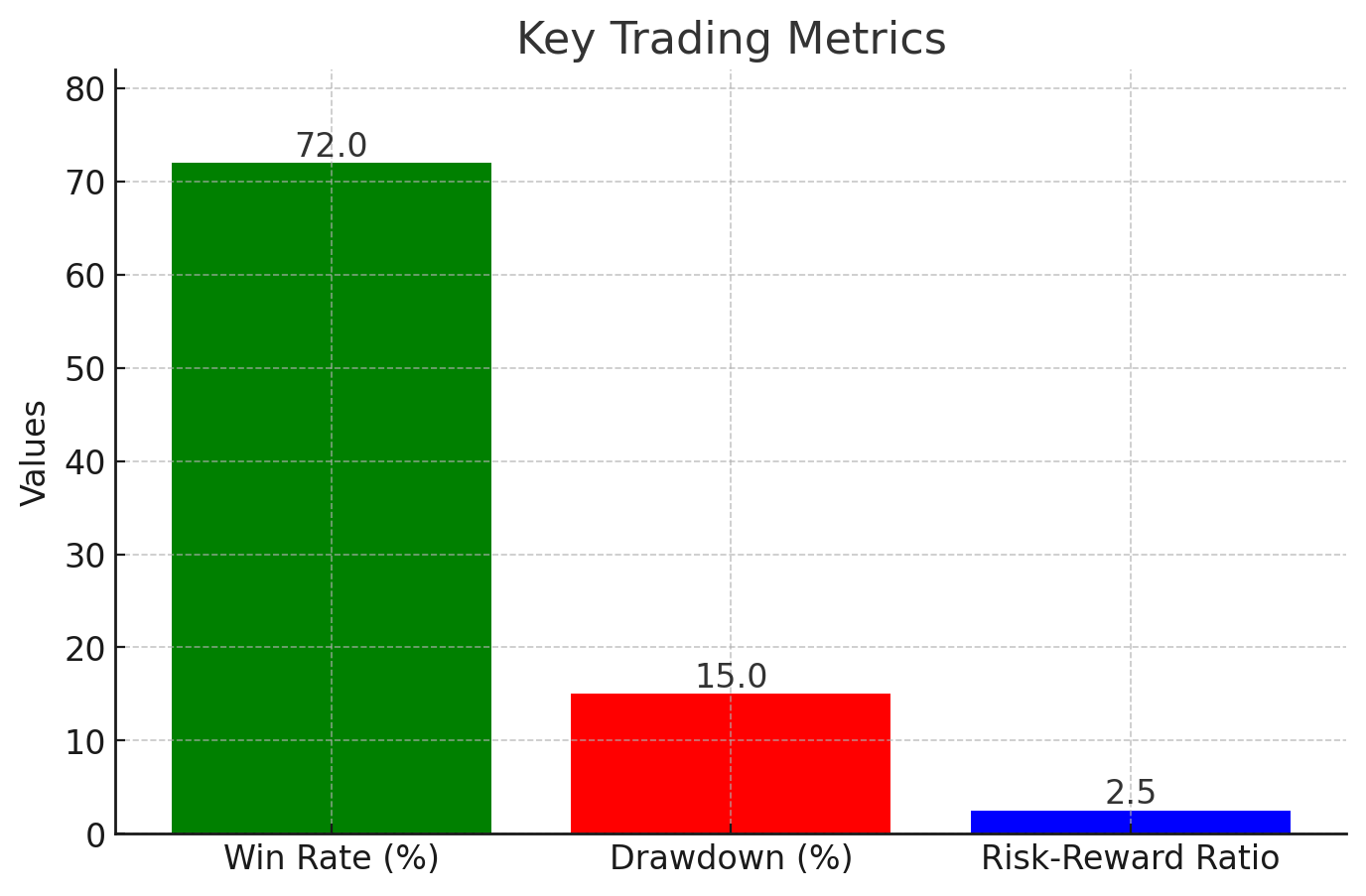

Win Rate: The percentage of trades that are profitable.

-

Drawdown: The peak-to-trough decline in the account balance. A lower drawdown indicates better risk management.

-

Risk-Reward Ratio: The ratio of potential profit to potential loss per trade. A higher ratio suggests a more favorable trading strategy.

-

Monthly/Annual Returns: Consistent, moderate returns are often more sustainable than erratic, high returns.

-

2. Risk Management

-

Why It Matters: Forex trading is inherently risky, and a good advisor should prioritize capital preservation. Effective risk management ensures that your trading account can withstand market volatility and avoid significant losses.

-

What to Look For: Ensure the advisor uses proper risk management techniques, such as:

-

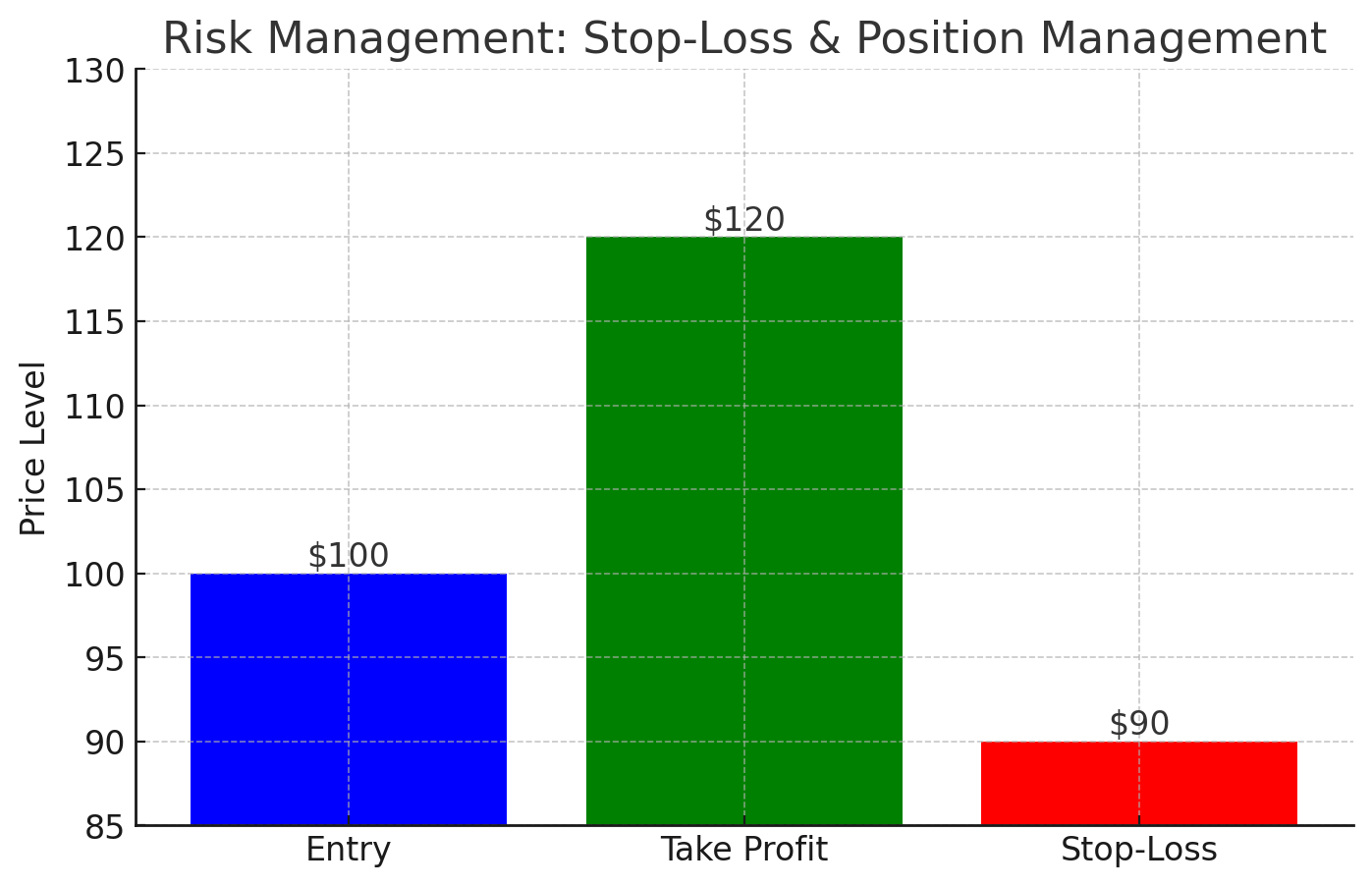

Stop-Loss Orders: Automatically close a trade at a predetermined loss level to limit downside risk.

-

Position Sizing: Adjust the size of each trade based on account balance and risk tolerance.

-

Diversification: Spread investments across different currency pairs to reduce exposure to any single asset.

-

Risk per Trade: A good rule of thumb is that the advisor should not risk more than 1-2% of the account balance on a single trade.

-

3. Transparency

-

Why It Matters: Transparency builds trust and allows you to understand how the advisor operates. A transparent advisor provides clear information about their trading strategy, fees, and performance, enabling you to make informed decisions.

-

What to Look For: The advisor should disclose:

-

Trading Strategy: Is it based on technical analysis, fundamental analysis, or a combination of both?

-

Performance History: Detailed records of past trades, including wins, losses, and overall profitability.

-

Fees and Costs: A breakdown of all charges, including subscription fees, performance fees, and any hidden costs.

-

Conflict of Interest: Ensure the advisor does not have any incentives that could compromise your interests.

-

4. Fees and Costs

-

Why It Matters: High fees can eat into your profits, especially if the advisor’s performance is mediocre. Understanding the fee structure is crucial to assessing the overall value of the advisor.

-

What to Look For: Compare the fee structures of different advisors. Common fee models include:

-

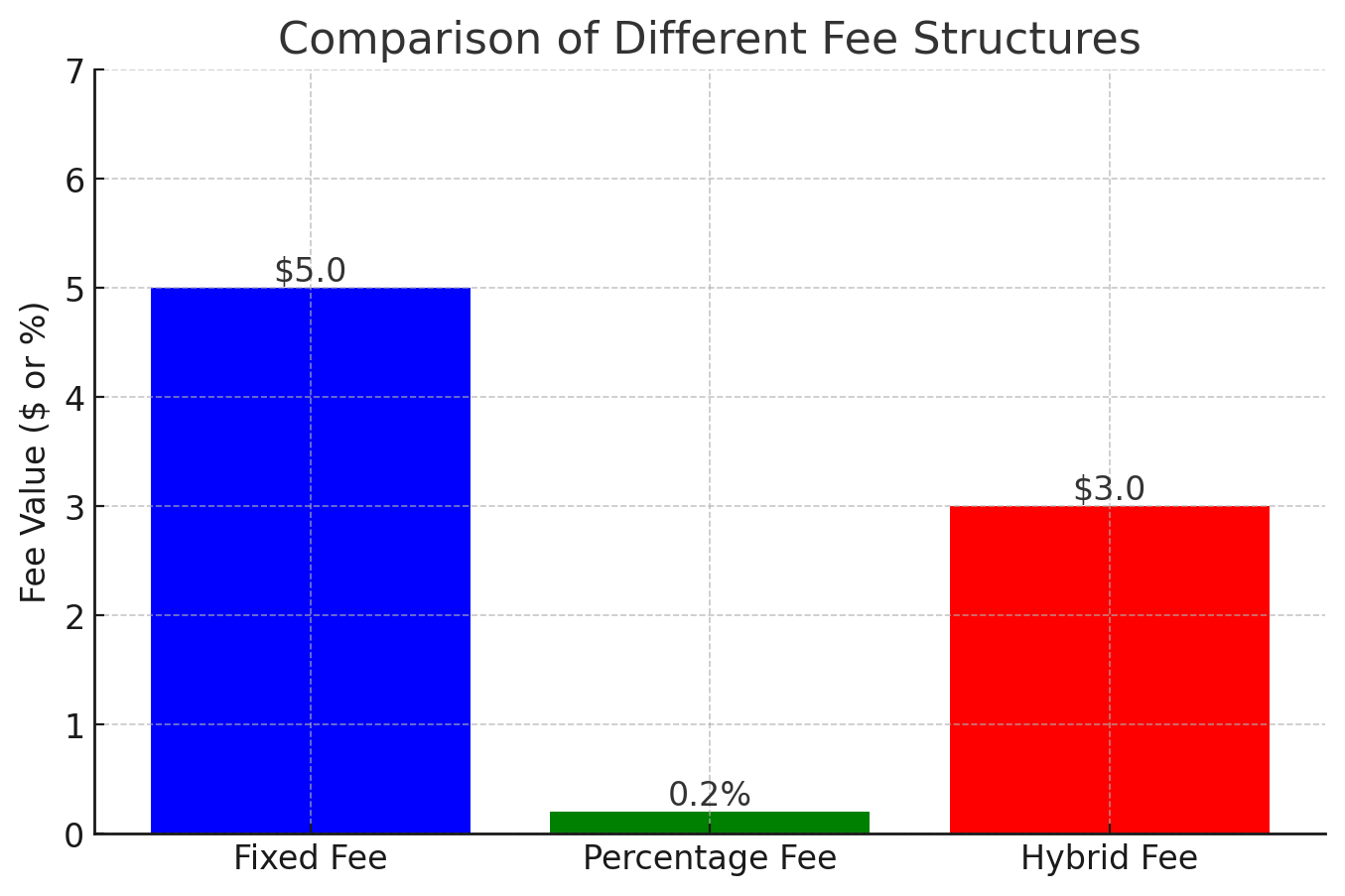

Fixed Fees: A set monthly or annual fee.

-

Performance Fees: A percentage of profits earned.

-

Hybrid Fees: A combination of fixed and performance fees.

-

Hidden Costs: Be wary of additional charges, such as withdrawal fees or platform fees.

-

5. Compatibility with Your Trading Style

-

Why It Matters: Your trading goals and risk tolerance should align with the advisor’s strategy. A mismatch can lead to frustration and poor performance.

-

What to Look For: Consider the following:

-

Risk Tolerance: If you’re a conservative trader, opt for an advisor with a low-risk, steady-returns approach. If you’re more aggressive, you might prefer an advisor with higher-risk, higher-reward strategies.

-

Time Horizon: Are you a day trader, swing trader, or long-term investor? Choose an advisor whose strategy aligns with your time horizon.

-

Currency Pairs: Ensure the advisor specializes in the currency pairs you’re interested in.

-

6. User Reviews and Reputation

-

Why It Matters: User feedback provides real-world insights into the advisor’s reliability and customer service. A strong reputation is a good indicator of quality.

-

What to Look For: Read reviews on platforms like Forex-Ratings.com and other forums. Look for patterns in feedback—consistent complaints about poor performance or hidden fees are red flags. Positive reviews should highlight:

-

Reliability: Consistent performance and minimal downtime.

-

Customer Support: Responsive and helpful service.

-

Ease of Use: User-friendly interface and clear instruction.

-

7. Ease of Use

-

Why It Matters: A user-friendly advisor saves time and reduces the likelihood of errors. Whether you’re using an automated system or working with a human advisor, ease of use is essential.

-

What to Look For: For automated advisors, ensure they integrate seamlessly with your trading platform (e.g., MetaTrader 4 or 5). For human advisors, assess their communication skills and responsiveness. Key features to consider include:

-

Setup Process: Is it straightforward and well-documented?

-

Interface: Is it intuitive and easy to navigate?

-

Support: Are there tutorials, guides, or customer support to help you get started?

-

8. Regulation and Security

-

Why It Matters: Regulation ensures that the advisor operates within legal and ethical guidelines. It also provides a layer of security and accountability.

-

What to Look For: Verify that the advisor is registered with a reputable regulatory body, such as:

-

FCA (UK): Financial Conduct Authority.

-

CFTC (US): Commodity Futures Trading Commission.

-

ASIC (Australia): Australian Securities and Investments Commission.

-

CySEC (Cyprus): Cyprus Securities and Exchange Commission.

-

9. Customer Support

-

Why It Matters: Reliable support is crucial for resolving issues and answering questions. Whether you’re dealing with technical problems or need clarification on trading strategies, responsive customer service is essential.

-

What to Look For: Test the advisor’s customer service before committing. Key aspects to evaluate include:

-

Response Time: How quickly do they respond to inquiries?

-

Availability: Do they offer 24/7 support or limited hours?

-

Channels: Are multiple communication channels available (email, phone, live chat)?

-

10. Trial Period or Demo Account

-

Why It Matters: A trial period allows you to test the advisor’s performance without risking real money. It’s an excellent way to evaluate their strategy and compatibility with your trading style.

-

What to Look For: Many advisors offer a demo account or a money-back guarantee. Use this opportunity to:

-

Test Performance: Evaluate the advisor’s performance in real-time market conditions.

-

Assess Compatibility: Ensure the advisor aligns with your trading goals and risk tolerance.

-

Identify Issues: Look for any technical glitches or inconsistencies.

-

Red Flags to Watch Out For

-

Guaranteed Profits: No advisor can guarantee profits in the volatile Forex market. Be skeptical of claims that sound too good to be true.

-

Lack of Transparency: Avoid advisors who refuse to disclose their trading strategy or performance history.

-

High Pressure Sales Tactics: Reputable advisors won’t pressure you into making a quick decision.

-

Unrealistic Returns: Be cautious of advisors promising exceptionally high returns with minimal risk.

How to Use our Rating to Choose an Advisor

Rating like Best Forex EAs are invaluable resources for comparing Forex advisors. Here’s how to make the most of them:

-

Filter by Criteria: Use filters to narrow down advisors based on performance, fees, risk level, and user ratings.

-

Read Detailed Reviews: Explore in-depth reviews and performance metrics for each advisor.

-

Compare Multiple Advisors: Don’t settle for the first option. Compare several advisors to find the best fit.

-

Check User Feedback: Pay attention to user reviews and testimonials to gauge real-world performance.

Final Thoughts

Choosing the right Forex advisor requires careful research and due diligence. By considering factors like performance, risk management, transparency, and compatibility with your trading style, you can make an informed decision. Platforms like Forex-Ratings.com provide a wealth of information to help you compare and evaluate advisors. Remember, there’s no one-size-fits-all solution—what works for one trader may not work for another. Take your time, test different options, and choose an advisor that aligns with your goals and risk tolerance.

Ultimately, a good Forex advisor can enhance your trading experience, but it’s not a substitute for education and discipline. Continuously educate yourself about the market, stay updated on global economic trends, and refine your trading strategy. With the right advisor and a proactive approach, you can navigate the Forex market with confidence and achieve your financial goals.