The USD/JPY pair is trading near 149.25 on Thursday, extending its downtrend since 15 January. However, the decline has been characterised by pauses and brief consolidations. The yen has strengthened to a five-month high, benefitting from the broad weakness of the US dollar. The dollar remains under pressure due to the appreciating euro and the impact of tariffs imposed by US President Donald Trump. Trump recently granted tariff concessions to certain automakers, but his latest tariff measures have triggered retaliatory actions from trade partners. Both developments have negatively affected the USD.

Meanwhile, Japan’s domestic focus remains on monetary policy and borrowing costs. Shinichi Uchida, Deputy Governor of the Bank of Japan (BoJ), stated this week that the BoJ may raise interest rates if economic conditions remain favourable. He also noted that Japan’s exit from ultra-loose monetary policy is just beginning. Uchida further emphasised that monetary conditions remain highly accommodative, with the BoJ’s reduction of government bond holdings still limited. These comments reinforce expectations that the yen could continue to appreciate in the near term.

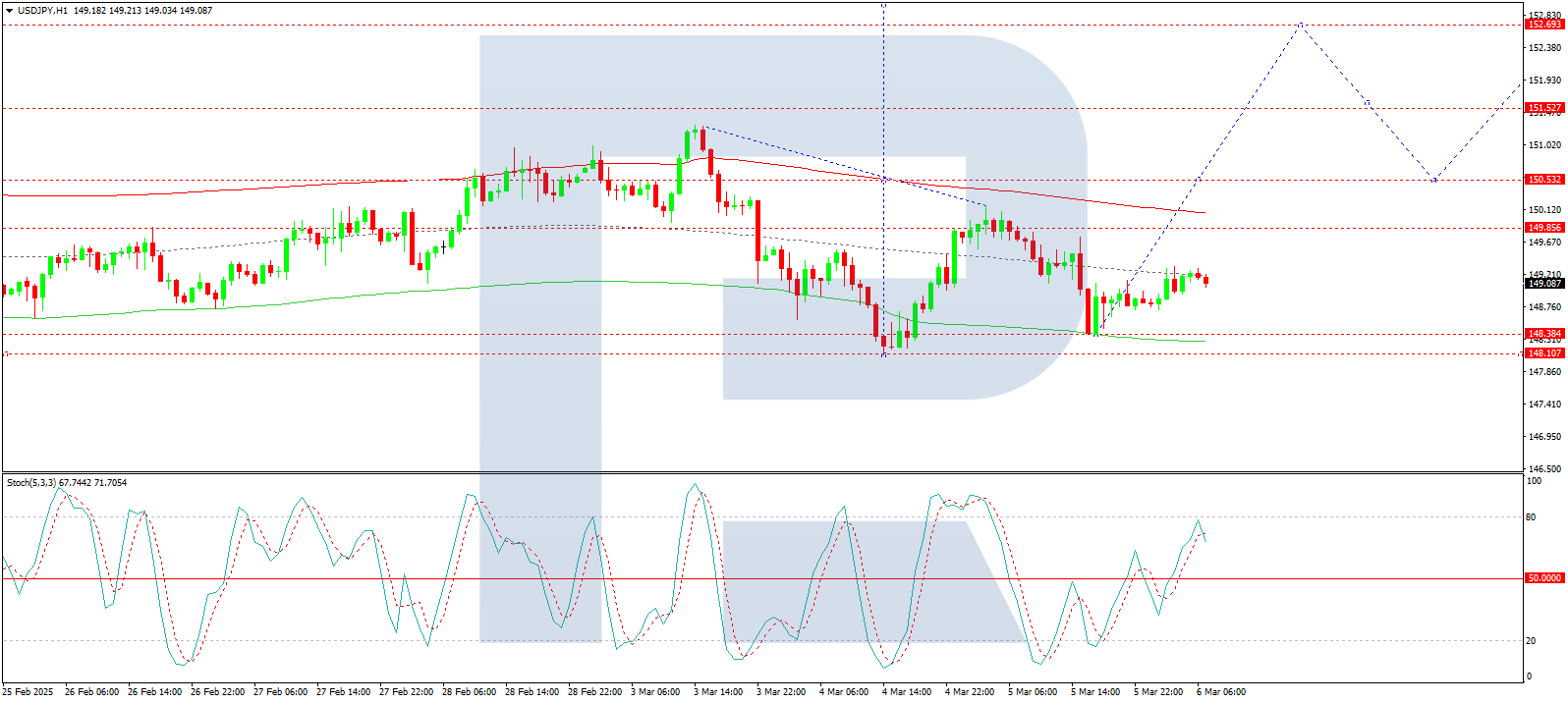

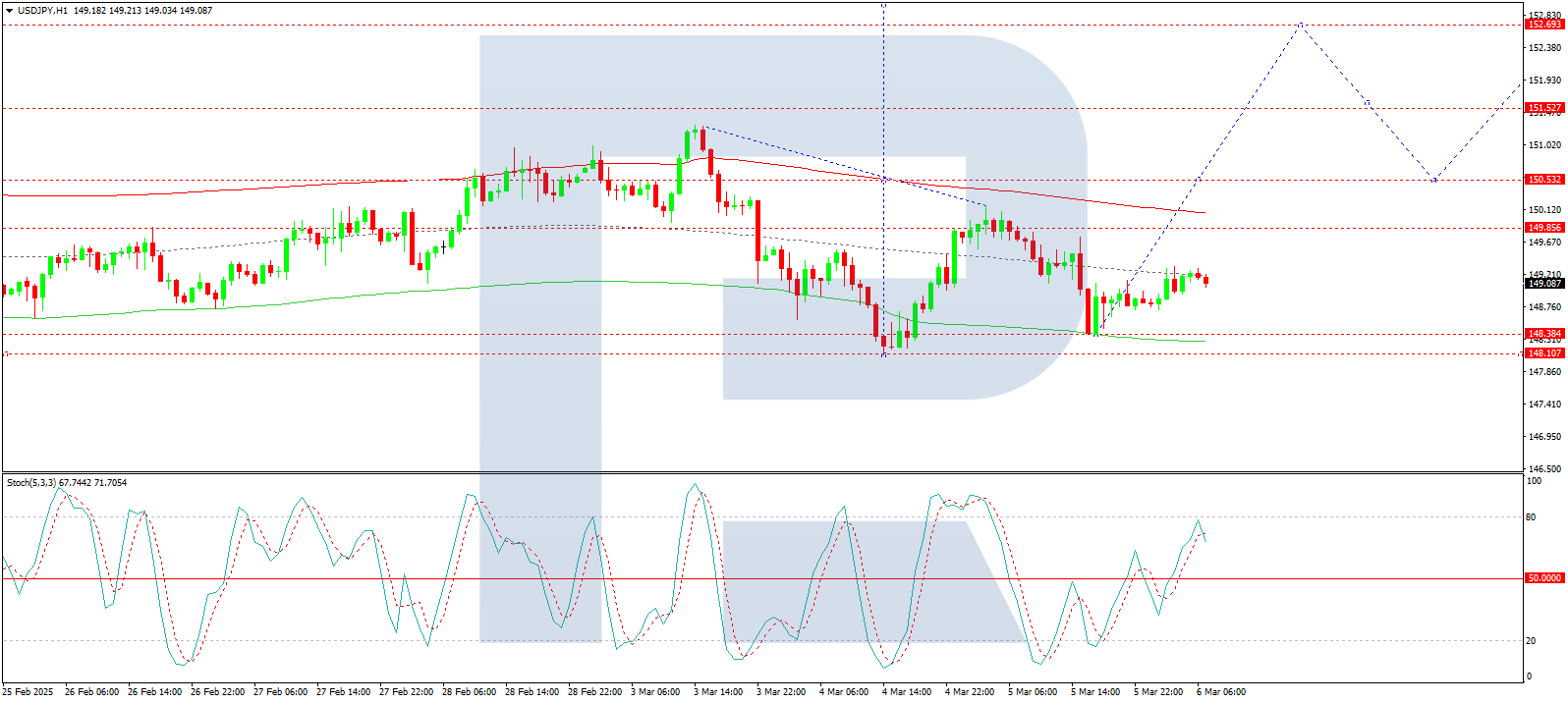

On the H4 chart, USD/JPY completed a growth wave to 150.17, followed by a correction to 148.38. The market is now forming a consolidation range near the lows. A new growth wave towards 150.55 is expected if an upward breakout occurs. If this level is breached, the uptrend could extend to 152.70, which serves as a local target. After reaching this level, a correction towards 150.55 may follow. The MACD indicator supports this scenario, with its signal line below zero but preparing for an upward move.

On the H1 chart, the market has completed a correction to 148.38. A new growth wave towards 150.55 is expected to develop. Upon reaching this target, a correction to 149.20 could follow. The Stochastic oscillator confirms this scenario, with its signal line above 50 and pointing upwards, suggesting renewed bullish momentum. USD/JPY continues to decline as yen strength persists, driven by expectations of BoJ policy shifts and US dollar weakness. While a potential correction towards 150.55 is on the horizon, the broader trend remains bearish unless key resistance levels are breached. The upcoming market movements depend on US trade policies, BoJ signals, and global risk sentiment.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.