GBP/USD has paused its upward movement near 1.2911, maintaining stability amid ongoing weakness in the US dollar. The pound remains firmly positioned, benefitting from two major factors: increased risk appetite in global markets and limited exposure to US trade tariffs, as the UK’s trade balance with the US is relatively small.

However, an internal risk factor looms over GBP. On 26 March, the UK government will announce its budget parameters. Finance Minister Rachel Reeves may unveil multi-billion-pound spending cuts to stabilise the UK’s public finances. Reeves has already noted that expanding defence commitments alongside rising government bond yields could create concerns in financial markets.

Despite this potential risk, fundamental support for the pound remains strong. The Bank of England (BoE) follows a transparent monetary policy that prioritises inflation control while allowing market-driven price adjustments. Additionally, the UK remains detached from broader geopolitical uncertainties, making it an economic safe zone compared to the more volatile Eurozone.

On the H4 chart, GBP/USD reached 1.2940, forming a consolidation range below this level. The price is expected to break downwards towards 1.2727. Once this level is reached, a new growth wave towards 1.2828 could begin. Looking further ahead, a decline to 1.2555 may develop. This scenario is confirmed by the MACD indicator, with its signal line at highs and pointing sharply downwards, indicating weakening bullish momentum.

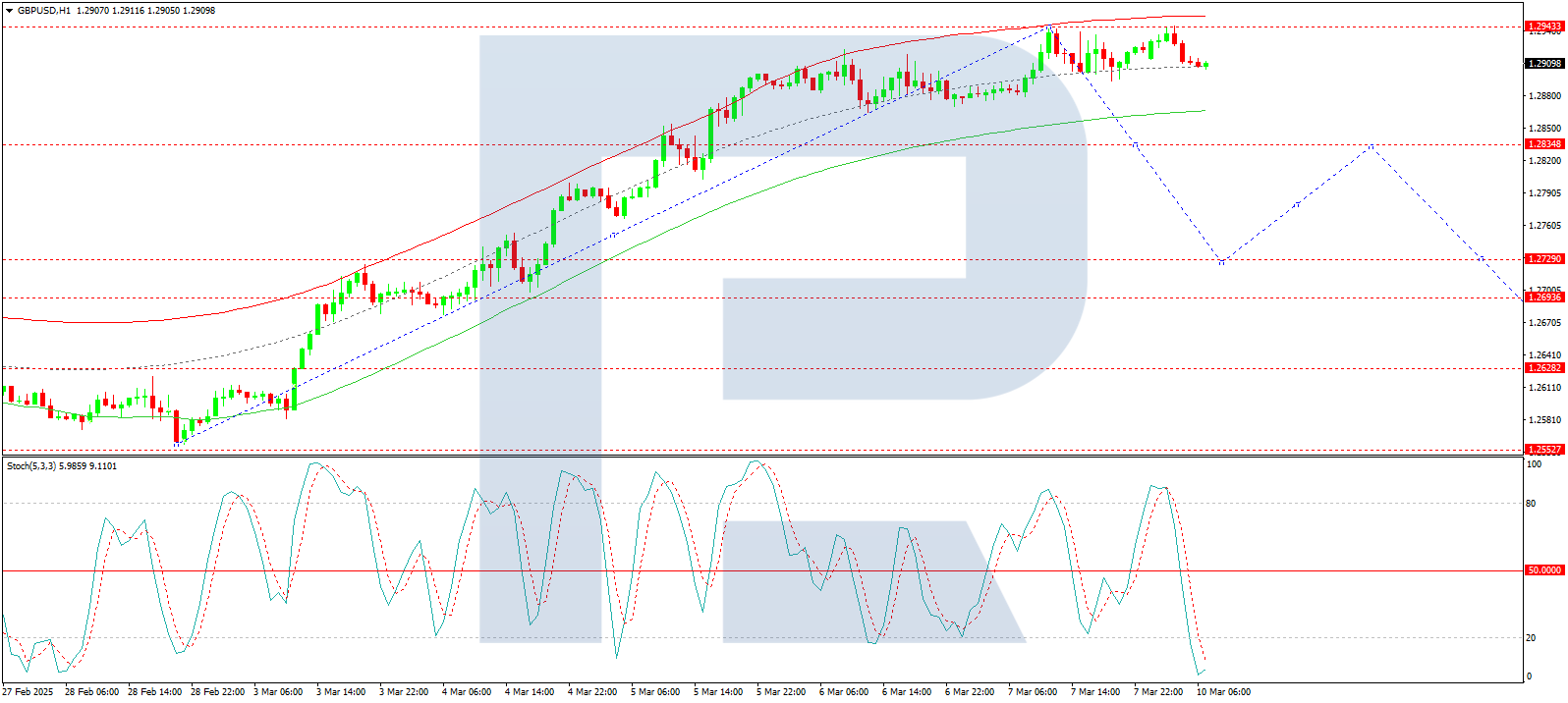

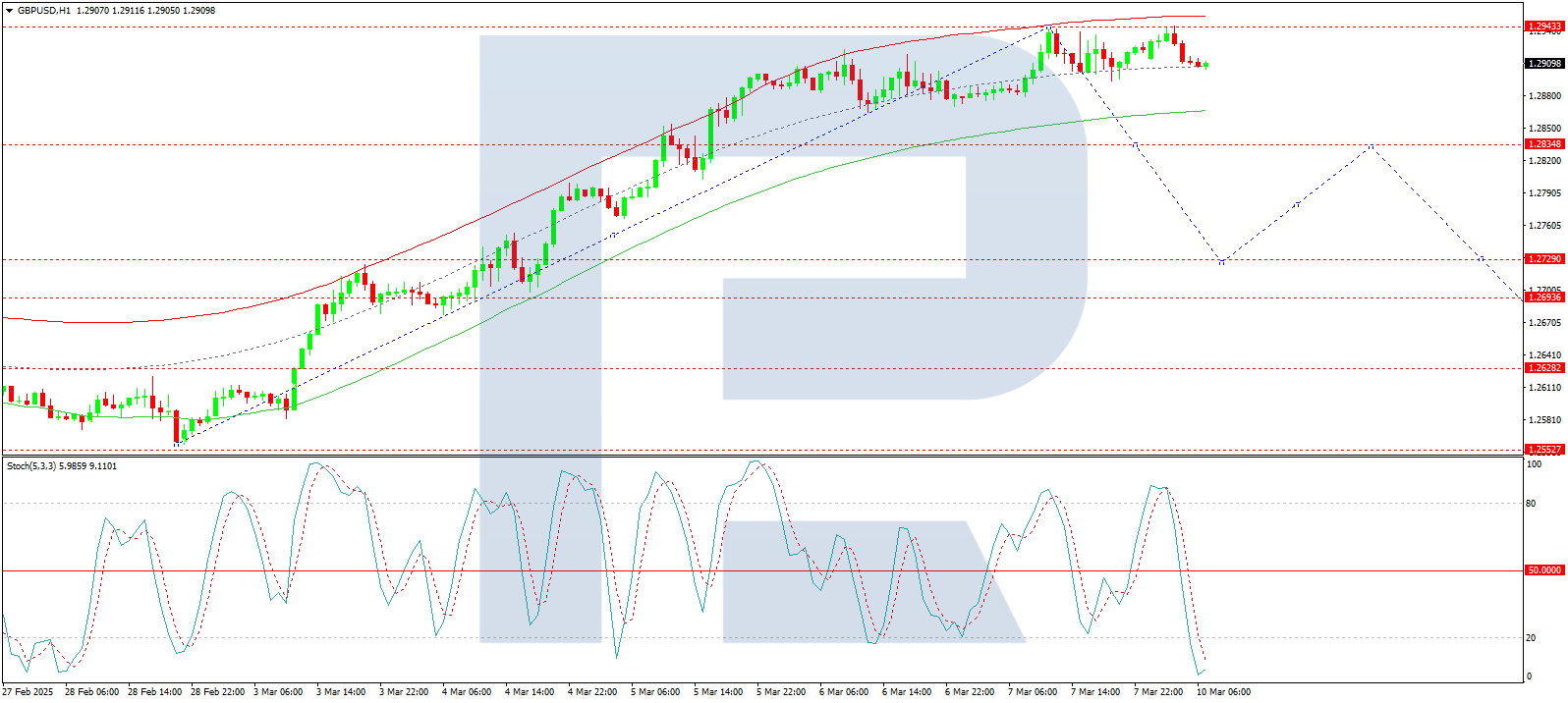

On the H1 chart, GBP/USD is forming a downward wave towards 1.2833, followed by a potential correction towards 1.2888. However, further downside towards 1.2727 remains likely, with this level as the first key target. The Stochastic Oscillator confirms this outlook, with its signal line below 50 and pointing firmly downwards, suggesting continued short-term bearish pressure.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.