GBP/USD has resumed its upward momentum and remains resilient, as recent economic data has tempered expectations of a looser monetary policy from the Bank of England (BoE). This strength has pushed the sterling towards its highest levels since November 2024, as long as inflation and economic growth in both the US and the UK remain stable.

The pair reached a new high for the year at 1.2674. Post-Brexit, the UK economy is less dependent on Europe, allowing GBP/USD to hold firm against both the euro and the US dollar. The BoE remains committed to combatting persistent inflation, and recent data suggests stronger economic activity in the UK. This reduces the likelihood of aggressive or rapid interest rate cuts, supporting the pound’s bullish outlook.

While the pound’s prospects remain favourable, risks persist. By the end of February, markets had largely adjusted to US President Donald Trump’s tariff rhetoric. So far, these remain just statements, but if his threats materialise into actual policies, both US inflation expectations and interest rates could rise. This could, in turn, limit the pound’s further growth.

A corresponding rise in UK bond yields may also cause investors to reassess the BoE’s stable financial approach. If yields climb too high, concerns over tighter financial conditions could weigh on GBP/USD.

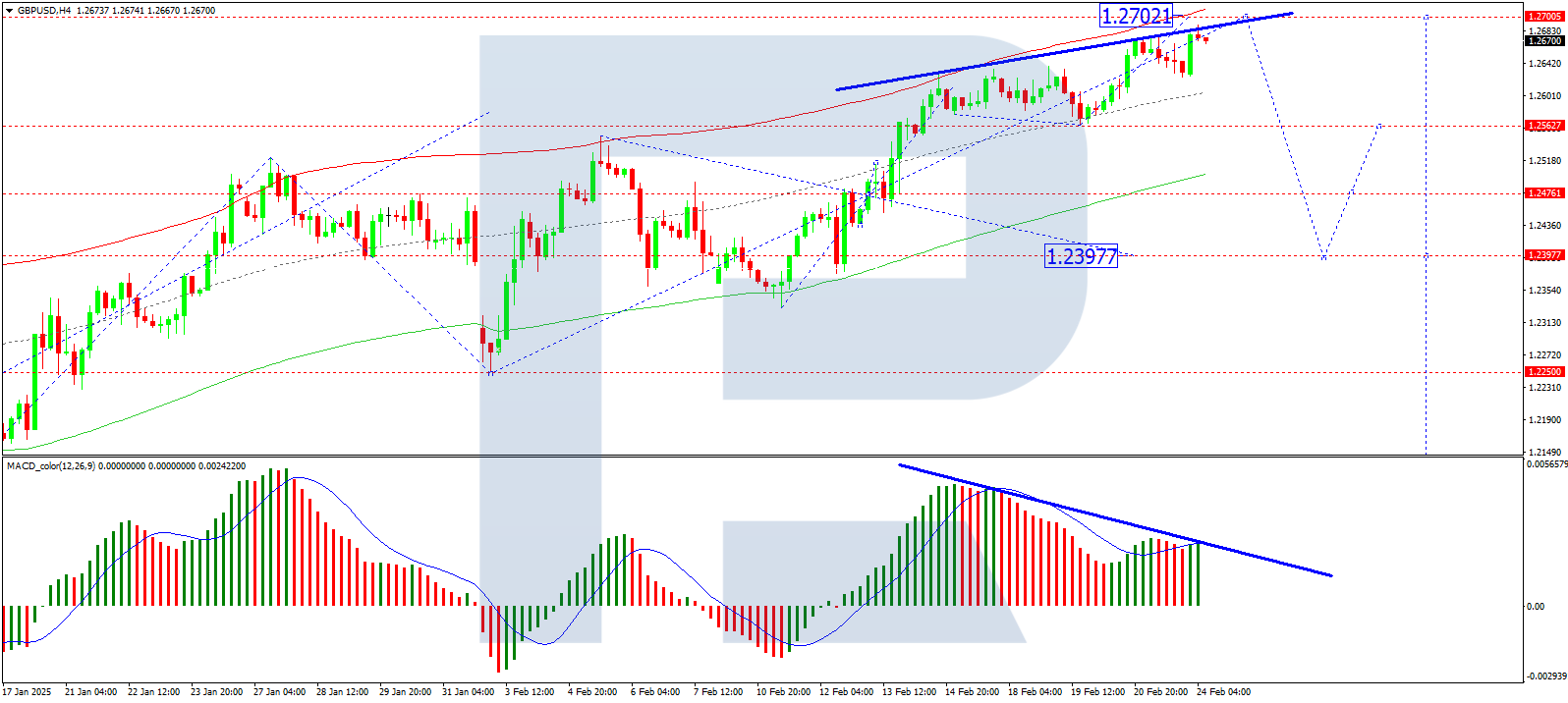

On the H4 chart, GBP/USD continues its upward trend, targeting 1.2700. A consolidation range has formed around 1.2626, and we anticipate an upward breakout towards 1.2700. Once this level is reached, a downward wave towards 1.2560 could begin, possibly extending further correction to 1.2400. The MACD indicator supports this scenario, with its signal line still above the zero level at recent highs, suggesting that a pullback may soon emerge.

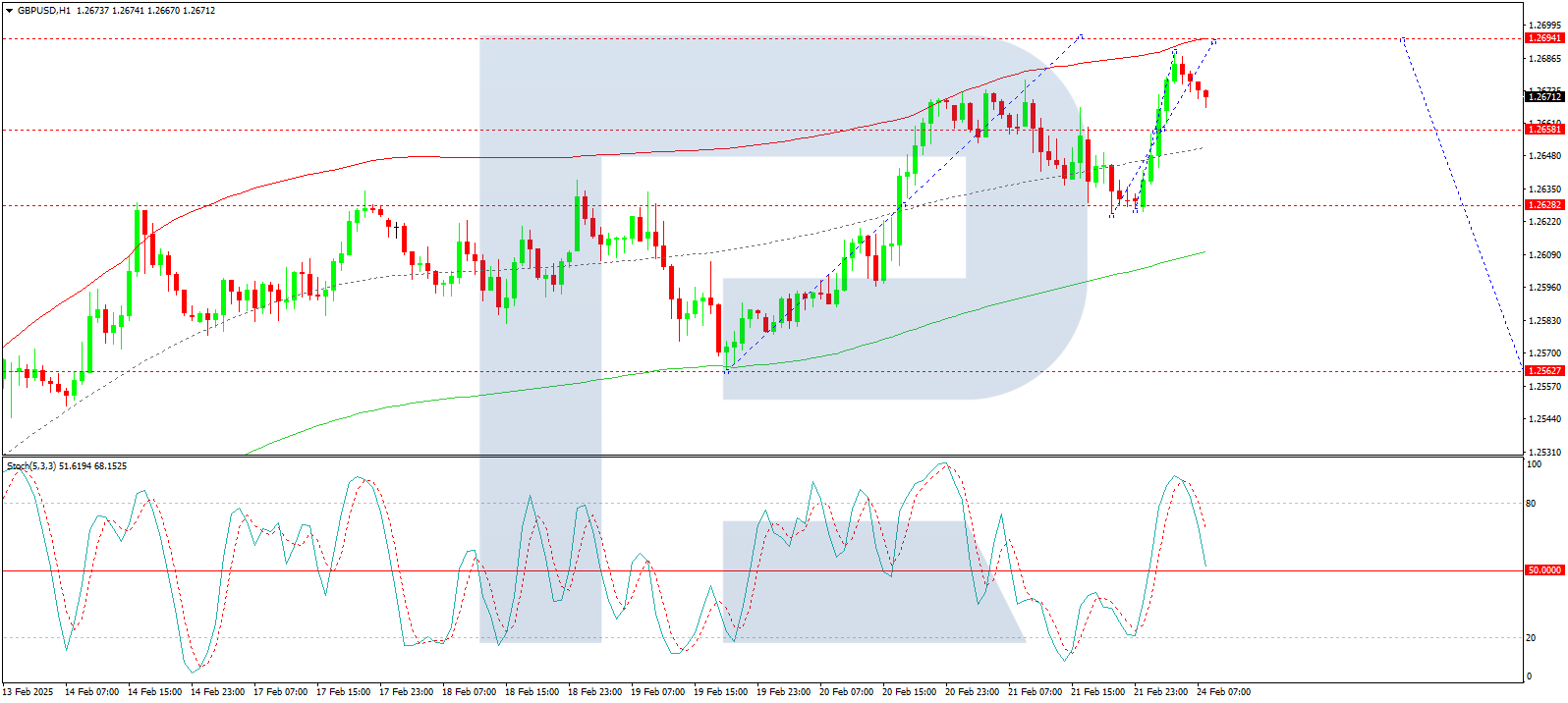

On the H1 chart, the pair found support at 1.2626 and is building a structure for a further move towards 1.2700. The local target of 1.2690 has already been reached. A short-term correction to 1.2658 (a test from above) is likely before another potential growth wave extends towards 1.2700. The Stochastic oscillator confirms this outlook, with its signal line below 80 and pointing downwards towards 50, indicating a corrective phase before further upside.

GBP/USD remains on an upward trajectory, supported by resilient UK economic data and reduced expectations for rapid BoE rate cuts. While the technical outlook points to further gains towards 1.2700, potential corrections could emerge before another leg higher. External risks, particularly US trade policy developments and shifting interest rate expectations, could limit the pound sterling’s advance in the coming weeks.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.