The EUR/USD pair declined to 1.0317 on Monday as the market reacted to a stronger US dollar driven by renewed trade tensions. Over the weekend, US President Donald Trump announced new global tariffs on steel and aluminium, adding to fears of escalating economic protectionism.

Key drivers behind the EUR/USD decline

The latest US tariff announcements have strengthened the USD, with investors seeking safety amid rising global trade uncertainty. Previously, the dollar had already gained support from expectations that the Federal Reserve would maintain elevated interest rates due to the resilience of the US labour market.

In contrast, the European Central Bank (ECB) is ready to continue cutting rates. The ECB has already indicated a likely rate reduction in March, and further monetary easing could follow if trade tensions escalate. Market expectations now suggest that ECB deposit rates may fall to around 1.87% annually by December 2025.

Reacting to Trump's tariff measures, German Chancellor Olaf Scholz stated that the EU would retaliate immediately if US trade restrictions extend to European exports. While Europe is open to negotiations, any failure in diplomatic efforts could increase economic and currency market volatility.

Technical analysis of EUR/USD

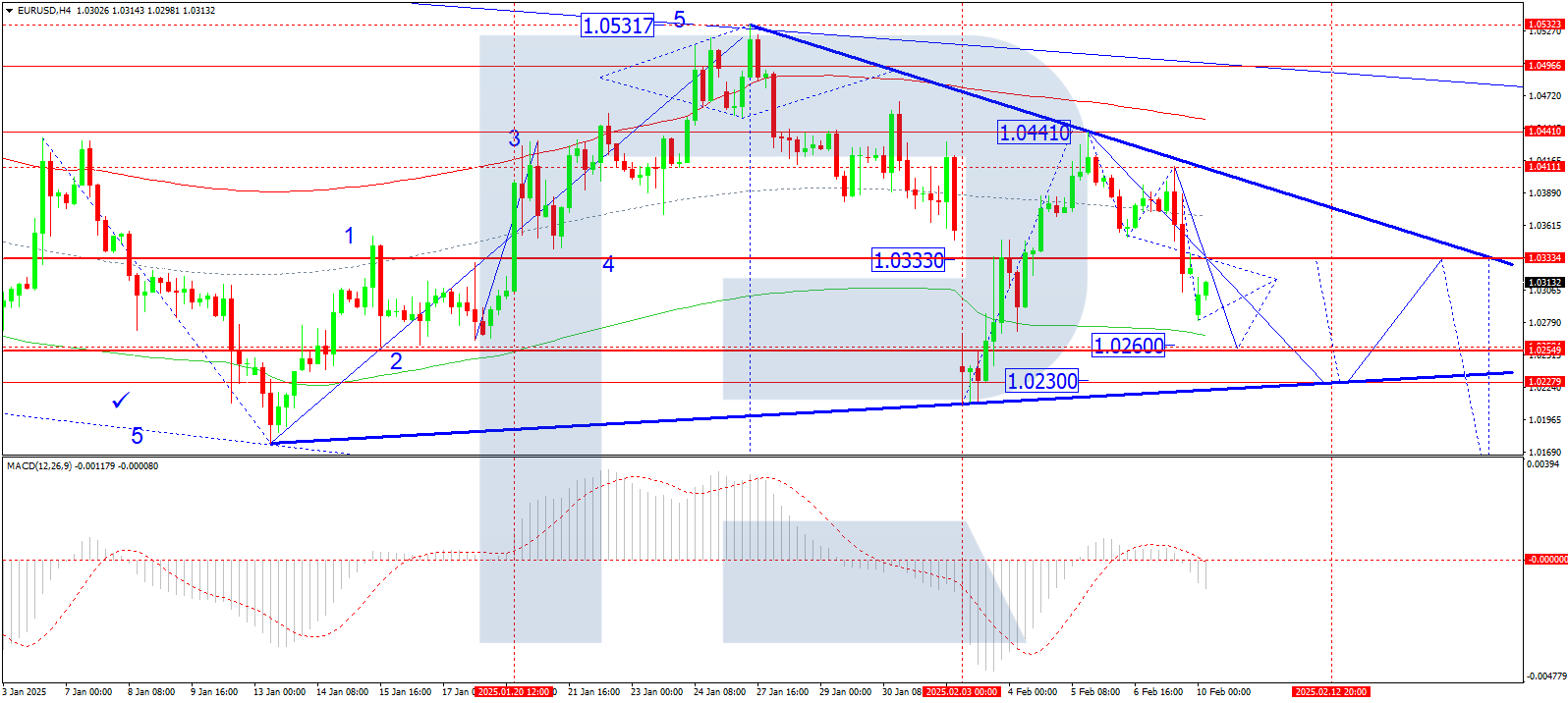

On the H4 chart, EUR/USD completed a downward wave to 1.0333, forming a consolidation range around this level. The pair has now broken below this range, opening the path for a further decline towards 1.0260, the current local target. After reaching this level, a corrective movement back to 1.0333 could develop before another downward wave targets 1.0230. The MACD indicator confirms this bearish scenario, with its signal line positioned below zero and pointing strongly downward, indicating the likelihood of new lows.

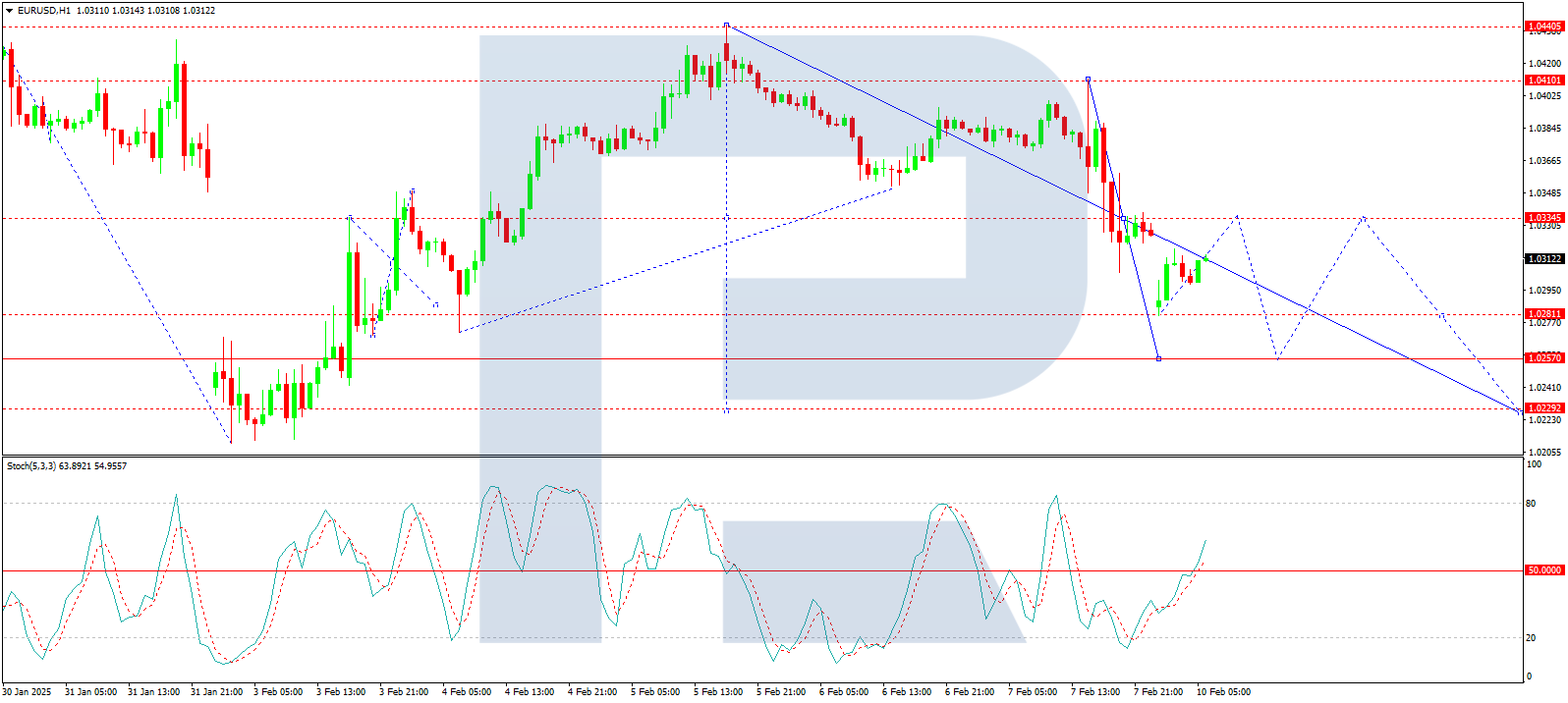

On the H1 chart, the market is structuring a decline towards 1.0260. The local target of 1.0280 has already been reached, and a corrective move towards 1.0333 (as a test from below) remains possible. However, after reaching this level, the downward wave is expected to resume, extending towards 1.0260 and potentially 1.0230. The Stochastic oscillator supports this scenario, with its signal line above 50 and moving towards 80, suggesting a short-term corrective move before further declines.

Conclusion

The EUR/USD pair remains under pressure due to a stronger US dollar and fears over escalating trade tensions. The euro faces additional headwinds, with the Federal Reserve maintaining a hawkish stance and the ECB leaning towards further rate cuts. Technical indicators point to further downside movement, with key targets at 1.0260 and 1.0230. Market participants will closely watch developments in US-EU trade relations, as any escalation could further weigh on the euro's outlook.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.