Key factors driving EUR/USD movements

The greenback faced additional pressure after the Trump administration announced tariff exemptions for smartphones, computers, and other tech products as part of a new reciprocal tariff program.

Despite the dollar’s sharp decline, Lutnick stated he remains unconcerned about the currency’s state. The dollar fell 3% last week, driven by escalating trade tensions and economic growth fears, prompting investors to dump US assets.

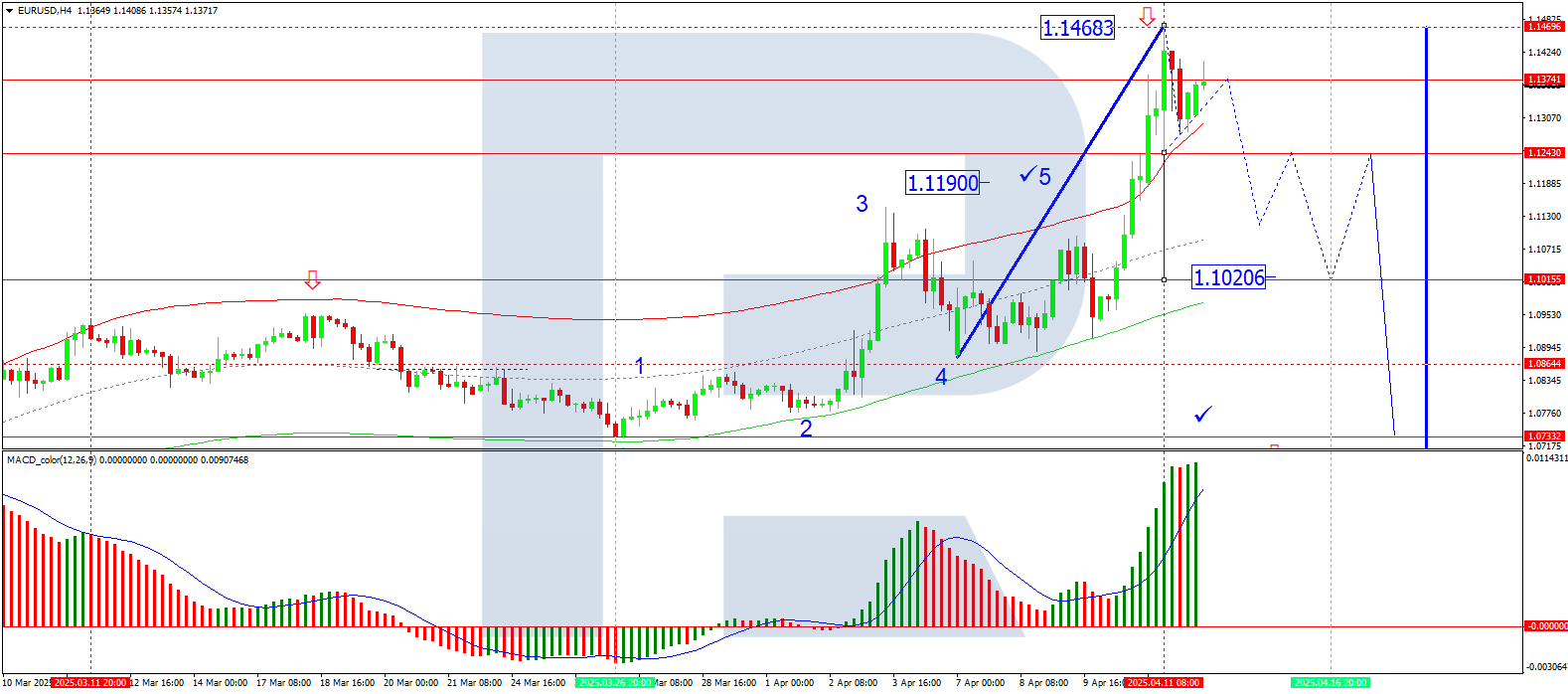

Technical analysis: EUR/USD

The EUR/USD chart shows a decline wave to 1.1276

Once complete, a further drop to 1.1111 (a local target) is expected

MACD confirmation: The signal line sits above zero at highs but is primed for a downward move

H1 Chart Outlook

Currently, the first decline wave (to 1.1276) and a correction (to 1.1400) have materialised

A break below this level could trigger a third decline wave to 1.1111, with a potential extension to 1.1100

Conclusion

The EUR/USD rally reflects broad dollar weakness, fuelled by economic uncertainty and trade risks. Technically, the pair shows corrective potential, but further downside remains likely upon key level breaches.