Key Drivers Influencing EUR/USD

This week, market participants are closely watching the release of US retail sales data for February, due on Monday. Additionally, the Federal Reserve’s two-day meeting, which begins on Tuesday, will culminate in an interest rate decision on Wednesday. While the consensus expectation is for borrowing costs to remain unchanged, any surprises could significantly impact the dollar’s trajectory.

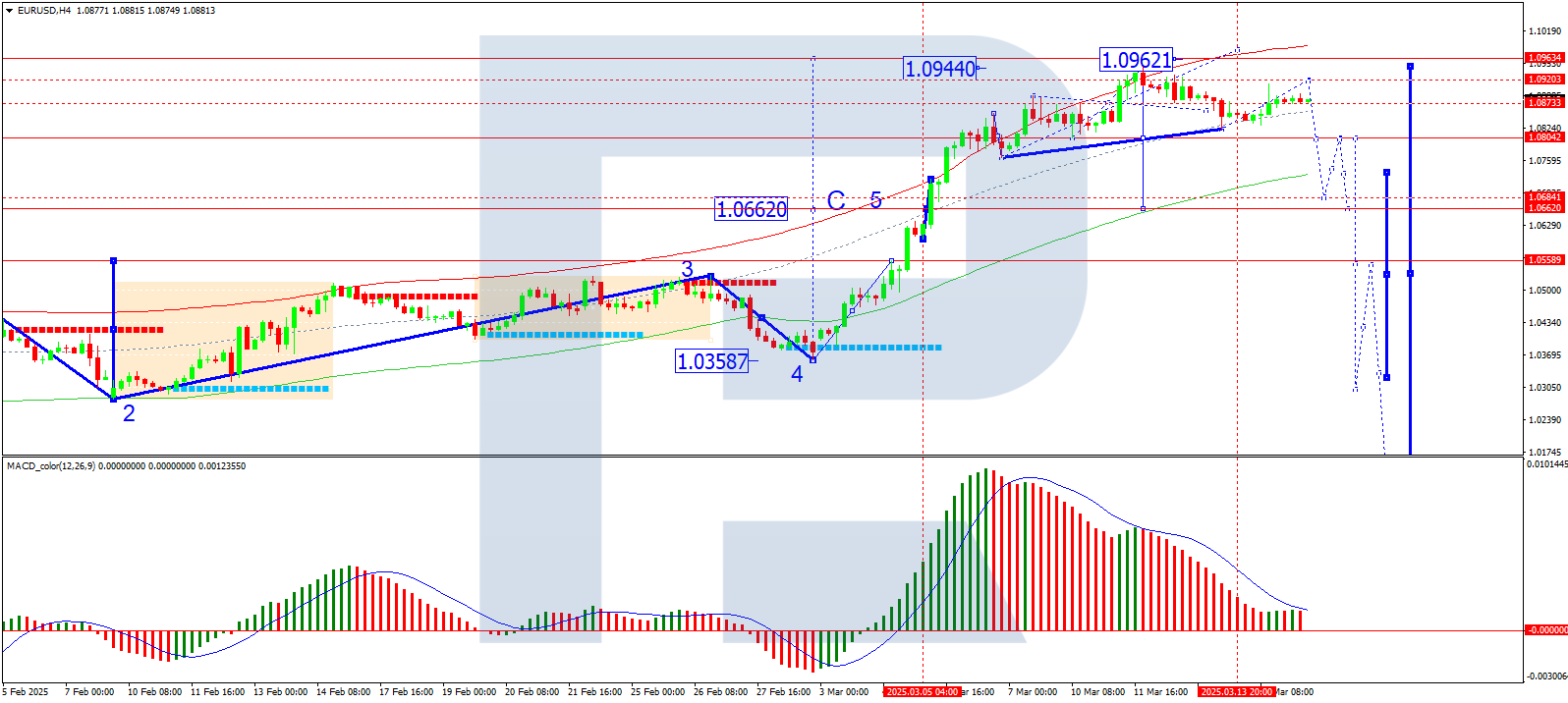

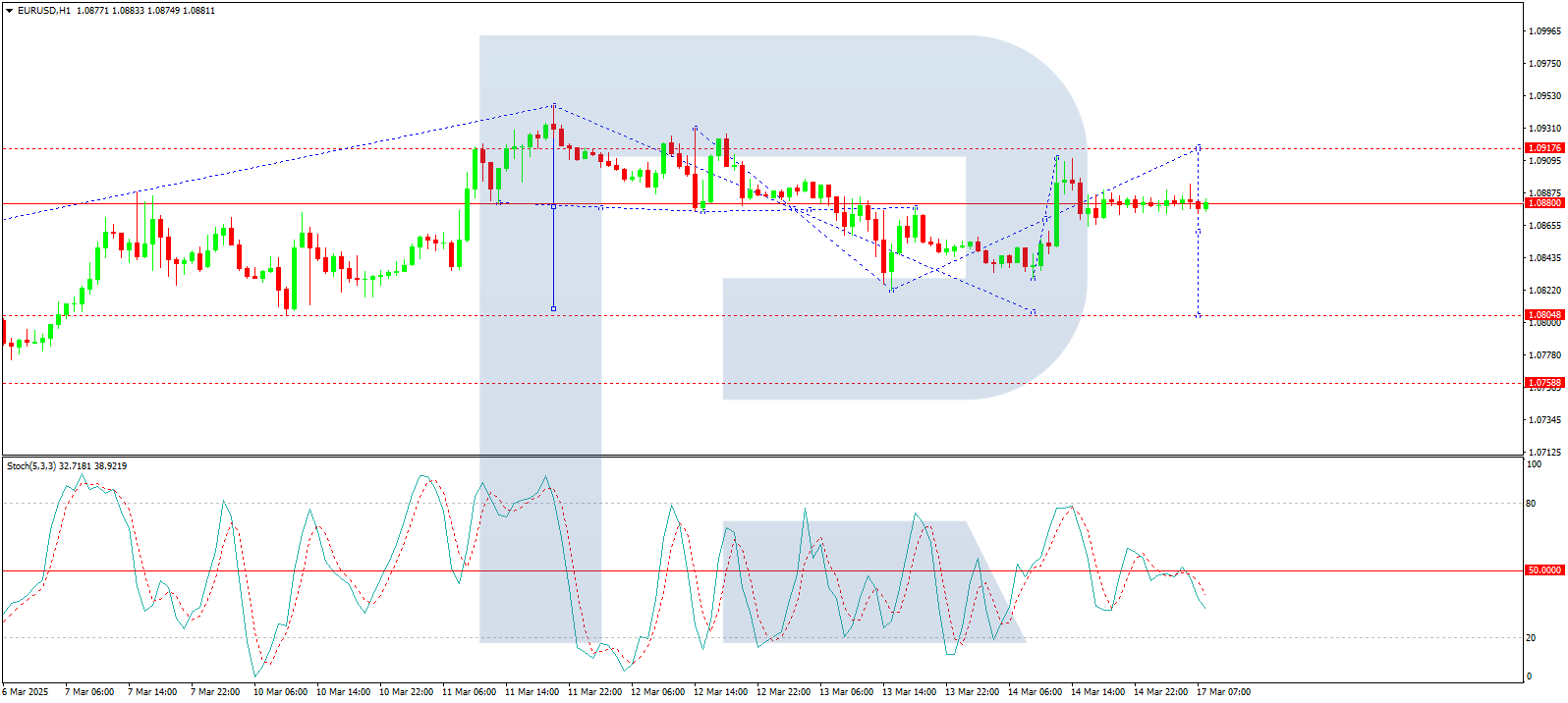

Technical Analysis of EUR/USD

The EUR/USD pair remains in a delicate balance, with the euro drawing strength from Germany’s fiscal measures and the US dollar facing headwinds from weak consumer confidence and inflation concerns. Traders should closely monitor key economic releases and the Federal Reserve’s upcoming decision, as these factors are likely to dictate the pair’s near-term direction. Technical indicators suggest a mixed outlook, with potential for both upward and downward movements depending on market sentiment and breakout scenarios.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.