The cryptocurrency market was hit by a sell-off over the weekend, the likes of which haven't been seen in a long time. We would not have been surprised to see such a sell-off before the halving due to the last takeout of buyers before the start of active growth. There is nothing unusual about such a downward amplitude in a bear market either, but not now, when the 4-year cyclical pattern should work on the bulls' side.

Our pessimistic scenario of a 20% decline in capitalisation to the 1.84 area has worked out, having made a very fast drop to the lower boundary of the corridor since March.

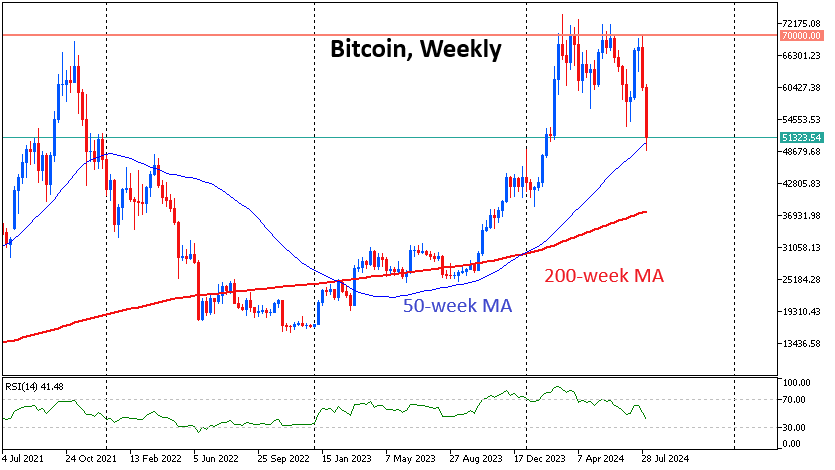

Bitcoin is down 13.5% from its peak at last week's close and has lost another 15% since the start of the day on Monday, falling below $49K at one point. Active pressure on the first cryptocurrency started after a failed attempt to go above $70K and overcome the resistance of the descending channel seven days ago. At the same time, its lower boundary turned out to be not so strong, and the price flew through it with an acceleration, finding itself also under the 50- and 200-day moving averages. Worse, at its lowest point, Bitcoin dipped below its 50-week average. Without strong buyer support right now, it goes even lower, and it would trigger an even more active sell-off as it did in late 2021 and early 2022. If it doesn't hold either, it's worth preparing for a failure towards $42K.

According to forecasting platform Polymarket, 48% of users believe Bitcoin will fall below the $60,000 mark in August. 26% of customers bet that BTC will drop to $55,000. 12% of users anticipate the first cryptocurrency to collapse to $50,000. Historically, August and September are considered the weakest months for BTC.

MicroStrategy acquired an additional 12,222 BTC for $805 million in Q2, bringing its total holdings to 226,500 BTC (~$14.7 billion). The average purchase price was $36,821 per coin; they spent a combined $8.5bn.

According to CNBC, Morgan Stanley's 15,000 financial advisors will offer spot bitcoin-ETF investments to their clients. The bank made this move first among Wall Street giants, reflecting the new stage of Bitcoin adoption. The reason behind the decision was the high demand from customers.

VanEck CEO Jan Van Eck said the first cryptocurrency is maturing, and its capitalisation will eventually reach half that of gold. Based on gold's current market capitalisation, the forecast calls for BTC to rise to $350,000 per coin. If central banks incorporate bitcoin into their ecosystems, it could potentially boost the asset's price to $1 million.

Hong Kong's largest online brokerage, Futu Securities International, has launched cryptocurrency trading for its 22 million users. Customers can trade BTC and ETH using Hong Kong dollars or US dollars.