Leverage trading, also known as margin trading, allows you to significantly magnify your profits in the markets. However, bear in mind that leverage is a double-edged sword - your losses are magnified as well. In the following lines, you’ll learn what leverage trading is and how to use it to trade the crypto market.

What is leverage?

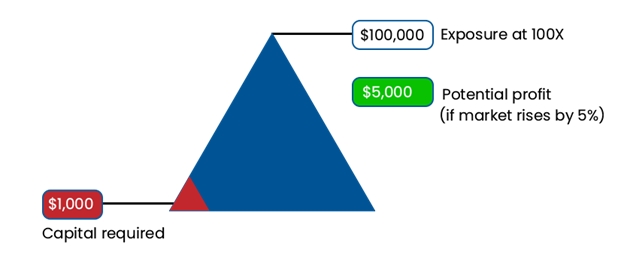

Leverage refers to the use of a small amount of capital to increase market exposure and trading positions via the use of borrowed funds. Leverage is sometimes also called margin trading. With leverage, it’s important to understand that the increased market exposure leads to magnified profits, even with small price movements in the market. For example, with a 10:1 leverage, a 1% move in the market would represent a 10% profit. However, not only your profits are magnified, but your losses as well.

Let’s say that a stock trades at $50 and your analysis shows that the price could reach $60 in the coming days. With a $1,000 account and 10:1 leverage, you could buy up to 200 shares at $50 and make a $2,000 profit if your market correction proves correct.

When trading on leverage, it’s very important to develop and stick to an effective risk management strategy. Potential losses that are magnified ten or even hundreds of times can quickly lead to a trading disaster.

What is the difference between leverage and margin trading?

Leverage and margin trading refers pretty much to the same thing. Leverage and margin are similar concepts that are connected to each other. So far, you’ve learned that leverage allows you to gain large market exposure via the use of borrowed funds. The funds are borrowed from your broker, and the collateral for the loan is called the margin.

The amount of margin you need to allocate for a leveraged trade depends on the leverage ratio that you’re using. For example, a leverage ratio of 100:1 requires a margin equal to 1% of the desired position size, while a leverage ratio of 25:1 requires a 4% margin for the same position size.

| Margin required leverage ratio | |

| 5.00% | 20:1 |

| 3.00% | 33:1 |

| 2.00% | 50:1 |

| 1.00% | 100:1 |

| 0.50% | 200:1 |

| 0.25% | 400:1 |

What is leverage in crypto trading

Trading on leverage works with any asset class, including cryptocurrencies. To trade cryptocurrencies on leverage, traders usually have two options to choose from: futures contracts or CFDs. Futures contracts are financial derivatives that are often used by professional traders to speculate on future price movements. Futures often come with leverage, which allows traders to increase their market exposure and magnify their trading results.

Nevertheless, the leverage ratio that comes with futures contracts is often multiple times lower compared to the leverage offered with CFDs. It’s not uncommon to see CFDs with a 100:1 leverage or even higher! This means you can control a position size of $1,000,000 with an initial deposit of only $10,000 and a leverage ratio of 100:1.

With that market exposure, you could buy up to $1,000,000 worth of cryptocurrencies, such as Bitcoin, Ethereum, or Litecoin, while allocating only $10,000 as collateral for the trade. After the trade hits your stop-loss or take-profit levels, or you close it manually, the collateral gets returned to your account and can be used for new trades.

How to manage risks when crypto trading

When trading cryptocurrencies on leverage, it’s very important to actively manage risks and always keep an eye on potential losses. Leverage magnifies both your profits and losses, which means that a few losing trades could make significant damage to your trading account. Here are a few tips on how to manage risks when trading crypto on leverage:

- Always use stop-losses. Stop-losses are very powerful when it comes to managing risks and keeping losses under control. A stop-loss automatically closes an open trade as soon as the price crosses a pre-specified price level.

- Define your risk-per-trade. Another step in managing risks when trading crypto on leverage is to define your risk-per-trade. As the name implies, this is how much you’re willing to lose on any single trade. If you’re new to trading, try to keep your risk-per-trade around 1% of your trading account size, or even lower.

- Define your reward-to-risk. Besides the risk-per-trade, the reward-to-risk of a trade setup is another important metric that helps you in managing your risks. The reward-to-risk divides the potential profit with the potential loss of a trade setup. Aim for setups with an R/R ratio of at least 2, i.e. you’re risking $1 to make $2.

- Identify important technical levels. It’s always a good idea to mark important support and resistance levels and to place your entry and exit orders around those levels. This way, you take advantage of the orders clustering around those levels and lower the chance of your stop-loss orders getting hit.

- Develop a trading plan. A trading plan should be a well-defined plan that covers all important aspects of your trading, including trading strategies, risk management, and trade management. All of the best traders have a trading plan in place, which allows them to focus on the markets and not trading rules.

Pros & Cons of Leverage Trading Cryptocurrency

Trading cryptocurrency on leverage comes with both advantages and disadvantages. However, with proper risk management and an effective trading plan, traders are able to mitigate most of the disadvantages of leverage.

Pros:

- Magnified profits: The most notable advantage of leverage is the ability to magnify even small price movements in the market.

- Diversification: Leverage allows traders to diversify their portfolios with the help of increased market exposure.

- Market exposure and position sizes: When trading on leverage, traders can control large position sizes with limited funds in their trading accounts.

Cons:

- Higher losses: Leverage magnifies not only your profits but also your losses.

- Trading account at risk: When overtrading with a small trading account, traders face the risk of losing all of their funds in the account if markets turn against them.

- Steeper learning curve: Trading on leverage requires some prior trading experience and knowledge about risk management.

Cryptocurrency Leverage Trading Strategies

Day trading and swing trading are the most popular trading styles used by retail traders to trade cryptocurrency on leverage. Day trading is a fast-paced trading style that involves opening and closing trades within the same trading day, while swing traders keep their trades open for days or even weeks.

Trade in fiat currencies. If you’ve already placed a trade on the crypto market, you may have noticed that altcoins are paired with Bitcoin and that Bitcoin is usually paired with USD. This means, when the market is in a bear phase, it’s better to trade with fiat currencies.

While trading altcoins is a great way to accumulate more Bitcoin, you need to be cautious during times of bear markets, as using a depreciating asset as your collateral can lead to larger losses.

- Lock in gains and diversify. When trading crypto on leverage, it’s important to lock in your gains as the market goes in your favor and to add to your winning positions. Using trailing stops could be a viable option to lock in your profits along the way while adding to your positions should only be done when your trade is profitable.

- Master a specific trading strategy. The key to successful trading is having a well-defined trading strategy and sticking to it, even during times when the strategy doesn’t yield results.

FAQ: Frequently Asked Questions

- What does 10x leverage mean? When trading with a 10x leverage, also known as a 10:1 leverage ratio, your buying power is 10x larger than your trading account size. In other words, you need to allocate a margin that equals 10% of your desired position size.

- Is cryptocurrency leveraged? When trading over an exchange, cryptocurrencies are usually not leveraged. However, when trading crypto CFDs, you can enjoy the benefits of a 100:1 leverage when trading with PrimeXBT.

- Does 5x leverage mean 5x profit? Yes, with a 5x leverage, your buying power and profits are magnified 5 times. However, bear in mind that your losses are magnified as well.

- How do you invest in leverage? When trading on leverage, you have to allocate collateral for the funds borrowed from your broker. That collateral is called the margin and its amount depends on the leverage ratio that you’re using.

- Can you buy Bitcoin with leverage? Yes, you can buy Bitcoin and any other popular cryptocurrency on leverage. For example, with a 100:1 leverage and a current Bitcoin market price of $50,000, you would need only $500 in your trading account to buy and get exposure to a full Bitcoin.