Slippage is a term that is used frequently in finance and applies to forex and stock markets. Slippage can bring you either loss or higher profit. Thus, it's essential to know how it occurs and how to avoid its negative impact. The meaning of slippage is simple. Slippage is the difference between the price at which you desire to enter or exit the market with the price at which the trade was executed. It can be positive or negative.

Slippage is a term that is used frequently in finance and applies to forex and stock markets. Slippage can bring you either loss or higher profit. Thus, it's essential to know how it occurs and how to avoid its negative impact.

Slippage: Definition

The meaning of slippage is simple. Slippage is the difference between the price at which you desire to enter or exit the market with the price at which the trade was executed. It can be positive or negative. Negative slippage occurs when your trade is executed at a worse price for you. Positive slippage means you get a better price to open or close your position. Usually, execution speed is the primary trigger of the slippage. Any delays between the placement of the order and its execution may lead to a price change. At the same time, slippage may happen if you hold a position overnight or over the weekend when the market is closed, and unexpected events cause incredible price spikes.

Slippage is the difference between the expected price with the price at which the trade was executed.

Don't confuse slippage with a spread. A spread is a difference between ask (sell) and bid (buy) prices that applies to any trade you open. The spread is the commission you pay to a forex broker to open a position. You can calculate the spread ahead and choose the asset that has the smallest spread. As for the slippage, you can't predict how much it will cost you and can barely forecast when it occurs. However, we will share the best tricks to predict slippage.

Why Slippage Happens

Let's consider the reasons for slippage, which will help build a strong strategy on how to avoid it.

High Volatility

The first and primary reason for slippage is high volatility. There's always volatility in the market; it's either low or high. In times of high volatility, the price changes so fast that the price you require can't be fulfilled by the market. A reliable broker, such as Libertex, should provide quick order execution to limit the slippage size. Economic events, unexpected news, and rumours are always a trigger of high volatility. The economic events are mentioned in the economic calendar. Nevertheless, it's not easy to accurately predict their effect. The situation becomes more difficult when the event isn't on the economic calendar.

Take a look at an example that happened on 9 March 2020. That day is called Black Monday due to the enormous stock market sell-off caused by the spread of the COVID-19 pandemic and the Russia-Saudi Arabia oil price war. Although Black Monday affected the stock market more, currency pairs also came under pressure.

Take a look at the EUR/USD pair, where long shadows signal high volatility.

The price moved very fast, so there would be a vast price gap between the time when you placed an order and when an authority executed it.

Low Liquidity

High liquidity means many active market participants are ready to fulfil your trade. If you're a seller, they're prepared to buy at the price you establish. If you're a buyer, they're ready to sell at the price you want. Low liquidity occurs when there aren't enough market participants who are prepared to offer the price you expect.

So, there's a significant time lag between the moment when you placed an order and the time when a buyer or seller was found. It mostly relates to unusual assets that aren't too popular among market participants.

Large Order

Another reason that appears less frequently but is worth mentioning is large orders. Slippage happens if you place a large order, but there's no interest in filling it at the desired price level.

How Slippage Occurs

Slippage equally applies to different types of markets. In terms of stocks, we're talking about the difference between ask and bid prices, the so-called spread. To avoid stock slippage, investors should avoid times of high volatility. Let's consider an example. Imagine you would like to buy Apple stocks (CFD). The bid-ask spread is 247.75 to 247.85. You suppose the price will rise, so you want to buy shares. However, high market volatility boosted the ask price to 248.25. The difference between 247.85 and 248.25 is slippage.

What Is Slippage in Trading?

Slippage in forex happens either because of high volatility or low liquidity. Let's imagine you want to sell the USD/SGD CFD pair that is considered as an unconventional pair that can be affected by low liquidity. Suppose you open a trade at the close price of the previous candlestick at 1.3872. However, due to the low liquidity, the next candlestick opens at 1.3893. This gap is a slippage that you would have to deal with due to the low liquidity.

We explained the negative slippage. Now let's look at the positive slippage. We'll consider the same example where you wanted to buy at 1.3872. However, there was a better price of 1.3865, so your order was filled at a better price.

How Slippage Affects Trading Transactions

It's essential to consider slippage while trading, as it's one of the factors that determine the final cost of your trade, including spread, swap and commission. If we talk about negative slippage, the higher slippage you experience, the worse trade you get. Slippage is one of the factors that determine the final cost of your trade, including spread, swap, and commission.

However, positive slippage will have the opposite effect on your trade, increasing the profit you get. Every trader looks for the best entry and exit levels. Imagine you buy an asset at a lower price or sell it at a higher price. Your income would improve immediately. However, it's significant that slippage doesn't occur when you exit the trade.

How to Avoid Slippage

Although it's impossible to predict the amount of slippage, it's possible to take some measures to prevent it.

Don't Trade in Times of High Volatility

High volatility occurs in times of important economic events, news and rumours. The first thing you should do is to avoid the market in times of notable economic releases. The list of important economic events is available via the economic calendar. The Bank of Canada had a meeting on 4 March 2020. Analysts didn't expect any changes to the interest rate. Nevertheless, the central bank cut the rate by 50bp. If you're familiar with the monetary policy rules, you know that the rate cut leads to a weak domestic currency, while a rate hike causes its appreciation. On the chart, we see the USD/CAD pair surged immediately after the bank's decision.

Don't Enter Low-Liquidity Markets

Liquidity depends on the asset you trade and trading hours. The major pairs, such as EUR/USD, GBP/USD, USD/JPY, USD/CAD, AUD/USD, NZD/USD and USD/CHF, have the highest liquidity. On the other hand, rare pairs, such as USD/TRY and USD/MXN, are traded less often, so their liquidity is lower.

Avoid times of high volatility and low liquidity.

As for the best trading hours, they depend on the asset you trade. Every market has trading sessions. If we talk about forex, we are looking at Australian, Asian, European and American sessions. For example, the Australian dollar will have high liquidity during Australian and Asian sessions because traders in those regions are more interested in AUD, which is used for financial operations, than in GBP.

Slippage and Order Types

There are two types of orders: market and limit. Slippage occurs when you apply to a market order. It means you want to open a trade right now at the market price. However, there are limit and stop-limit orders. They are executed only at a specific or better price.

Let's see how they work:

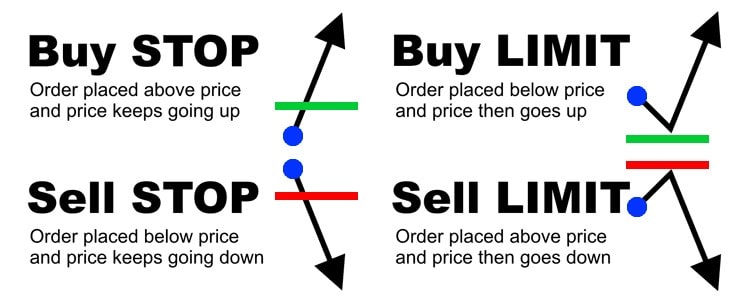

- Sell limit. When you place a sell limit order, you expect the price to rise to a certain level and pull back and move down. Thus, it's an instruction to sell the asset at the specified price or higher. The chosen price is always higher than the current one.

- Buy limit. Buy limit order means you expect the asset to fall to a certain level and return back up. So, you assume the trade will be opened at a specified price or lower. The specified price is always below the current market price.

- Sell stop. When placing a sell stop order, you expect the price to break below a certain level and continue falling. That means the entry price is lower than the current one.

- Buy stop. If you place a buy stop order, you expect the price to break above a certain level and continue rising. Thus, an entry price is higher than the current one.

A significant advantage of limit orders is the ability to place Stop-Loss and Take-Profit levels that help manage your risks. The only limitation of the limit orders is that your trade may never be filled if the price doesn't reach the level you placed.

A significant advantage of limit orders is the ability to place Stop-Loss and Take-Profit levels that help manage your risks.

Nonetheless, slippage may happen not only when you open a position but when you close it. To avoid the slippage closing a trade, use guaranteed Stop-Loss orders. A guaranteed stop-loss differs from the standard one as it will close the trade at the level you specified. However, a guaranteed stop-loss isn't free. You'll have to pay a premium when it's triggered.

Reliable Broker

Slippage can be either negative or positive. If the market moves in your favour and offers a better price, a trustworthy provider, such as Libertex, will execute the position at a better price. If the slippage is negative for you and surpasses an acceptable level, a broker should reject the trade and ask you to resubmit it. Also, a broker should have low slippage rates and fast execution speed that will limit the size of the slippage.

FAQ

Here are some questions you may have.

What Is Broker Slippage?

A broker slippage is a difference between the price you require and the price at which the broker opens your trade. Usually, the slippage size depends on the provider you choose as the speed of the market execution, and the slippage rate differs from broker to broker. First, it's essential to find a broker with a low slippage rate, such as Libertex. A slippage rate means there's a range within which the price can be executed, even if there's a difference with the requested price. This range won't hit your trade, so you don't lose a lot of your capital. If the price exceeds this rate, the broker will ask you to resubmit the trade.

Another critical issue is the type of execution. If the broker fills the trade at the market price, that means the slippage can occur in times of high volatility or low liquidity. If the broker offers an instant execution option, the trade will be filled accurately at the desired price or may not be filled at all due to sharp price changes during the process of placing an order.

How Can We Stop Trading Slippage?

It's impossible to remove the slippage entirely. Every trader has experienced slippage at least once in their trading career. Although it's possible to check significant economic events and avoid trading during them, there is no chance to predict unexpected news and rumours. Markets are driven not only by fundamental factors but by the market participants who form the market sentiment. It's impossible to fully remove the slippage.

Recently, world central banks have been holding unscheduled meetings and cutting interest rates due to the COVID-19 pandemic. Such events are unpredictable and not placed on the economic calendar. Thus, traders can't predict them and place either a limit order or avoid trading at all.

All you can do is find a reliable broker that will guarantee a low slippage rate in case of negative slippage and trade execution at a better price in case of positive slippage.

How Do You Measure Slippage?

It's easy to calculate slippage, as it's just a difference between the desirable price and the final price at which the trade was executed. If you placed a long position at the level of 1.3500, but the trade was opened at 1.3502, 2 pips are your slippage.

Conclusion

Slippage is an integral part of trading along with spread, swap and commission. Although it's impossible to get rid of negative slippage, it's possible to reduce its impact. As for positive slippage, it's essential to find a regulated broker like Libertex that will execute your trades at the best market price.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.